Rising Energy Demand

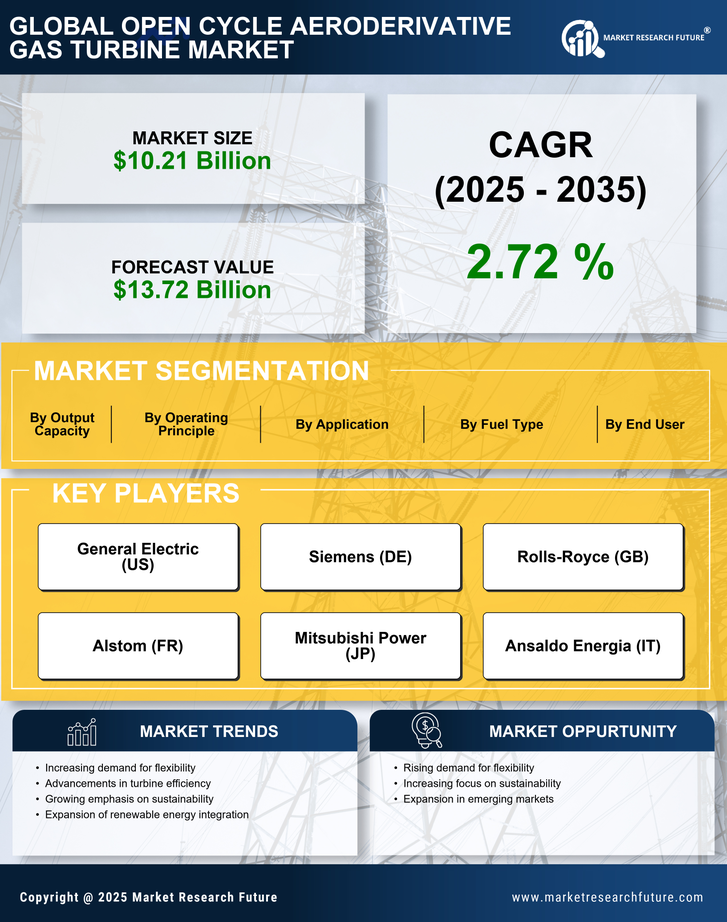

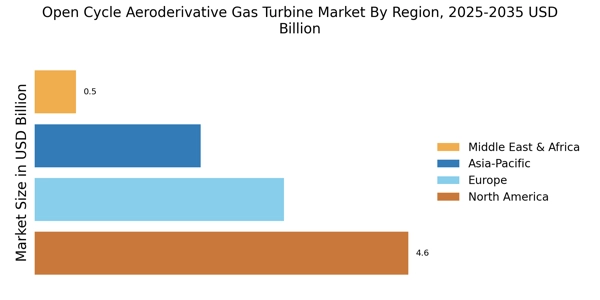

The Open Cycle Aeroderivative Gas Turbine Market is experiencing a surge in demand for energy due to increasing industrialization and urbanization. As economies expand, the need for reliable and efficient power generation becomes paramount. This trend is particularly evident in developing regions where energy consumption is projected to grow significantly. According to recent estimates, global energy demand is expected to rise by approximately 30% by 2040. This escalating demand for energy is likely to drive investments in gas turbine technologies, including open cycle aeroderivative systems, which offer rapid deployment and operational flexibility. Consequently, the Open Cycle Aeroderivative Gas Turbine Market is poised for substantial growth as stakeholders seek to meet the rising energy needs of various sectors.

Environmental Regulations

The Open Cycle Aeroderivative Gas Turbine Market is influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting cleaner energy sources. Governments worldwide are implementing policies that encourage the adoption of technologies with lower environmental footprints. Open cycle aeroderivative gas turbines are recognized for their ability to operate with lower emissions compared to traditional fossil fuel power generation methods. This regulatory landscape is likely to propel the market forward, as industries seek to comply with environmental standards while maintaining operational efficiency. The increasing focus on sustainability and the transition to cleaner energy sources may further enhance the attractiveness of open cycle aeroderivative gas turbines, positioning the Open Cycle Aeroderivative Gas Turbine Market favorably in the evolving energy landscape.

Technological Innovations

Technological advancements play a crucial role in shaping the Open Cycle Aeroderivative Gas Turbine Market. Innovations in turbine design, materials, and control systems are enhancing the efficiency and performance of these gas turbines. For instance, advancements in aerodynamics and combustion technology are enabling higher efficiency rates and lower emissions. The integration of digital technologies, such as predictive maintenance and real-time monitoring, is also improving operational reliability and reducing downtime. As a result, the market is witnessing a shift towards more sophisticated and efficient turbine systems. The ongoing research and development efforts in this sector suggest that the Open Cycle Aeroderivative Gas Turbine Market will continue to evolve, driven by the need for improved performance and reduced environmental impact.

Investment in Infrastructure

Investment in energy infrastructure is a significant driver for the Open Cycle Aeroderivative Gas Turbine Market. As countries seek to modernize their energy systems and expand capacity, there is a growing emphasis on building new power plants and upgrading existing facilities. Open cycle aeroderivative gas turbines are often favored for their quick installation and operational flexibility, making them an attractive option for new projects. Recent reports indicate that global investments in energy infrastructure are projected to reach trillions of dollars over the next decade. This influx of capital is likely to stimulate demand for open cycle aeroderivative gas turbines, as stakeholders prioritize technologies that can deliver reliable and efficient power generation in a rapidly changing energy landscape.

Integration with Hybrid Systems

The Open Cycle Aeroderivative Gas Turbine Market is increasingly integrating with hybrid energy systems, combining gas turbines with renewable energy sources. This integration allows for enhanced flexibility and reliability in power generation, addressing the intermittency issues associated with renewable sources like solar and wind. By utilizing open cycle aeroderivative gas turbines in conjunction with renewables, energy providers can ensure a stable power supply while reducing reliance on fossil fuels. This trend is likely to gain momentum as the energy sector shifts towards more sustainable practices. The potential for hybrid systems to optimize energy output and improve overall efficiency positions the Open Cycle Aeroderivative Gas Turbine Market as a key player in the transition to a more sustainable energy future.