Micro Gas Turbine for Aeroderivative and Energy Market Summary

As per Market Research Future analysis, the Micro Gas Turbine for Aeroderivative and Energy Market Size was estimated at 138162.2 USD Million in 2024. The Micro Gas Turbine industry is projected to grow from 149367.15 USD Million in 2025 to 1.398636829850291e+62 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 8.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Micro Gas Turbine for Aeroderivative and Energy Market is poised for substantial growth driven by technological advancements and increasing demand for distributed energy solutions.

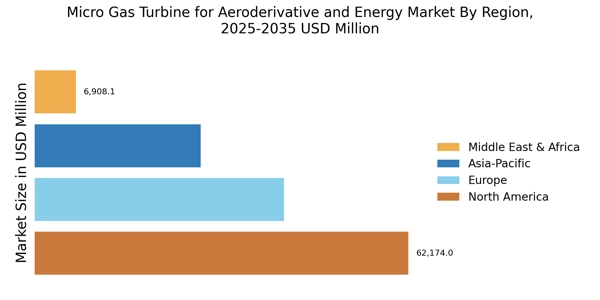

- North America remains the largest market for micro gas turbines, driven by robust industrial applications and energy efficiency initiatives.

- The Asia-Pacific region is emerging as the fastest-growing market, fueled by rapid urbanization and increasing energy demands.

- Recuperated micro gas turbines dominate the market, while non-recuperated models are gaining traction due to their cost-effectiveness and efficiency.

- Key market drivers include technological advancements in micro gas turbines and a growing demand for distributed energy solutions, supported by regulatory incentives.

Market Size & Forecast

| 2024 Market Size | 138162.2 (USD Million) |

| 2035 Market Size | 1.398636829850291e+62 (USD Million) |

| CAGR (2025 - 2035) | 8.11% |

Major Players

Capstone Turbine Corporation (US), Solar Turbines Incorporated (US), General Electric Company (US), Rolls-Royce Holdings plc (GB), Mitsubishi Power, Ltd. (JP), Ansaldo Energia S.p.A. (IT), Siemens Energy AG (DE), Kawasaki Heavy Industries, Ltd. (JP), Turbine Engine Corporation (US)