Rising Energy Demand

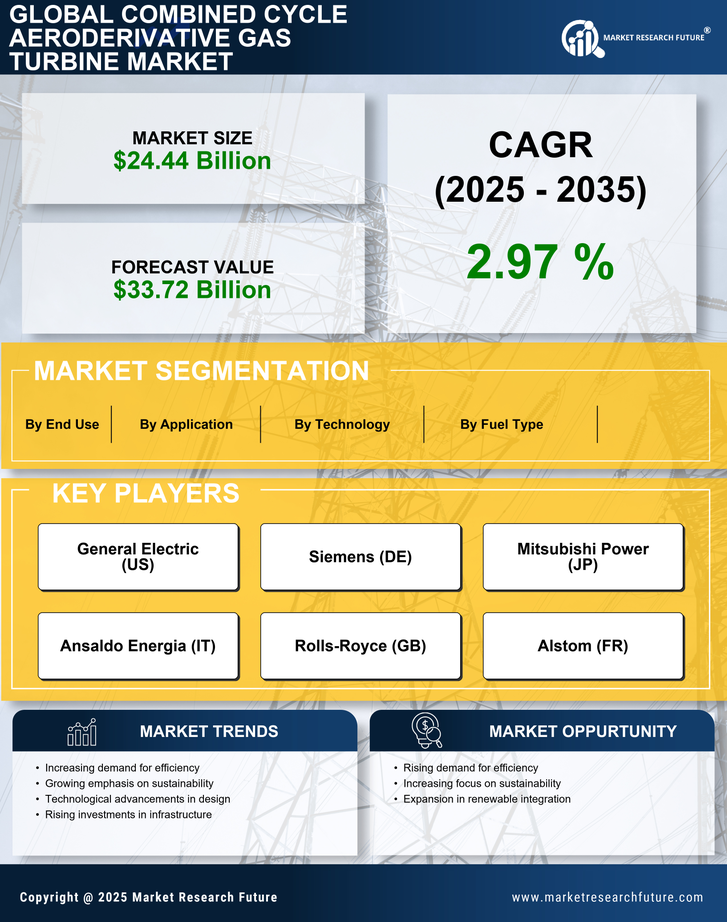

The increasing The Combined Cycle Aeroderivative Gas Turbine Industry. As economies expand and populations grow, the need for efficient and reliable energy sources intensifies. According to recent data, energy consumption is projected to rise by approximately 30% by 2040, necessitating the deployment of advanced power generation technologies. Combined cycle aeroderivative gas turbines, known for their high efficiency and lower emissions, are well-positioned to meet this demand. This trend indicates a shift towards cleaner energy solutions, further propelling the market as utilities and independent power producers seek to enhance their generation capabilities while adhering to regulatory standards.

Technological Innovations

Technological innovations are reshaping the Combined Cycle Aeroderivative Gas Turbine Market, enhancing efficiency and performance. Recent advancements in turbine design, materials, and control systems have led to significant improvements in operational efficiency, with some models achieving efficiencies exceeding 60%. These innovations are critical as they allow operators to maximize output while minimizing fuel consumption and emissions. Furthermore, the integration of digital technologies, such as predictive maintenance and real-time monitoring, is optimizing turbine performance and reliability. As these technologies continue to evolve, they are likely to drive further adoption of combined cycle aeroderivative gas turbines in various applications, from peaking power plants to baseload generation.

Regulatory Support for Clean Energy

Regulatory frameworks promoting clean energy are significantly influencing the Combined Cycle Aeroderivative Gas Turbine Market. Governments worldwide are implementing stringent emissions regulations and incentivizing the adoption of low-carbon technologies. For instance, policies aimed at reducing greenhouse gas emissions are encouraging the transition from coal to natural gas, where combined cycle aeroderivative gas turbines play a crucial role. The International Energy Agency has noted that natural gas could account for nearly 40% of the global power generation mix by 2030. This regulatory support not only fosters market growth but also aligns with global sustainability goals, making the technology increasingly attractive to investors and operators.

Investment in Infrastructure Development

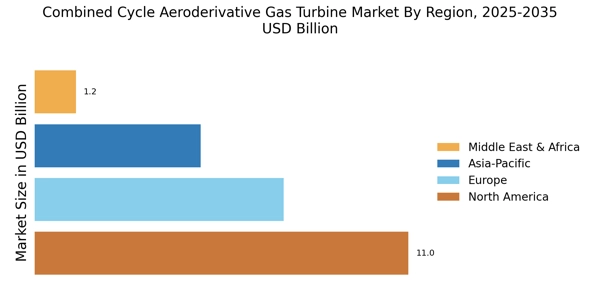

Investment in infrastructure development is a key driver for the Combined Cycle Aeroderivative Gas Turbine Market. Many countries are focusing on modernizing their energy infrastructure to accommodate growing energy needs and enhance grid reliability. This trend is particularly evident in emerging markets, where substantial investments are being made in power generation facilities. For example, the Asian Development Bank has projected that infrastructure investments in the energy sector could reach trillions of dollars over the next decade. Such investments are likely to include the deployment of combined cycle aeroderivative gas turbines, which offer flexibility and efficiency, thereby supporting the transition to more resilient energy systems.

Shift Towards Decentralized Energy Systems

The shift towards decentralized energy systems is influencing the Combined Cycle Aeroderivative Gas Turbine Market. As energy consumers increasingly seek localized solutions, the demand for smaller, modular power generation technologies is rising. Combined cycle aeroderivative gas turbines, with their ability to operate efficiently at various scales, are well-suited for distributed generation applications. This trend is further supported by advancements in energy storage technologies, which enhance the viability of decentralized systems. According to industry forecasts, the market for distributed energy resources is expected to grow significantly, creating new opportunities for combined cycle aeroderivative gas turbines in both urban and rural settings.