Increasing Electric Vehicle Production

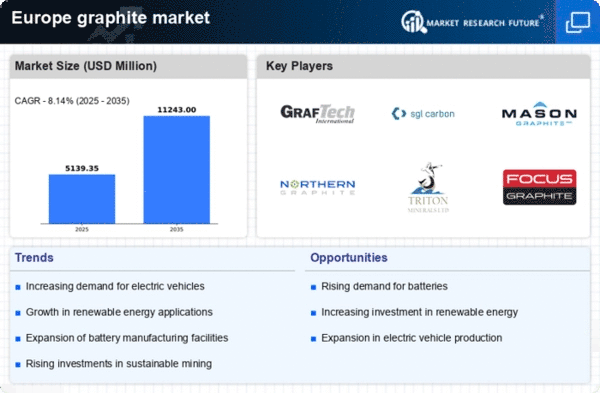

The surge in electric vehicle (EV) production in Europe is a pivotal driver for the graphite market. As automakers pivot towards electrification, the demand for battery-grade graphite, essential for lithium-ion batteries, is expected to rise significantly. In 2025, the European EV market is projected to grow by approximately 30%, necessitating a robust supply of high-quality graphite. This trend is further supported by government incentives aimed at reducing carbon emissions, which encourage manufacturers to adopt electric technologies. Consequently, the graphite market is likely to experience heightened activity as companies strive to meet the increasing demand for battery components, thereby influencing pricing and supply chain dynamics.

Rising Demand for Graphite in Electronics

The electronics sector in Europe is experiencing a notable increase in demand for graphite, which serves as a crucial material in various applications, including semiconductors and conductive coatings. As the market for consumer electronics expands, the graphite market is likely to benefit from this trend. Projections suggest that the electronics market could grow by 15% annually through 2027, driving the need for high-quality graphite. This demand is further fueled by the increasing integration of smart technologies and the Internet of Things (IoT) in everyday devices. Consequently, the graphite market may see a diversification of its customer base, as electronics manufacturers seek reliable sources of graphite to meet their production needs.

Expansion of Renewable Energy Storage Solutions

The growing emphasis on renewable energy sources in Europe is driving the need for efficient energy storage solutions, which in turn bolsters the graphite market. Graphite is a critical component in the production of batteries used for storing energy generated from solar and wind sources. As Europe aims to achieve its renewable energy targets, the demand for advanced battery technologies is expected to escalate. Reports indicate that the energy storage market could expand by over 25% by 2026, creating a substantial opportunity for the graphite market. This shift towards sustainable energy solutions may lead to increased investments in graphite mining and processing, further enhancing the industry's growth prospects.

Technological Innovations in Battery Manufacturing

Technological advancements in battery manufacturing processes are reshaping the graphite market landscape in Europe. Innovations such as solid-state batteries and enhanced anode materials are likely to increase the efficiency and performance of batteries, thereby driving demand for high-purity graphite. The European battery manufacturing sector is projected to invest over €10 billion in research and development by 2027, focusing on improving battery technologies. This investment is expected to create a ripple effect in the graphite market, as manufacturers seek to source superior graphite materials to meet the evolving specifications of next-generation batteries. The interplay between technology and material requirements may lead to a more competitive market environment.

Regulatory Support for Sustainable Mining Practices

Regulatory frameworks in Europe are increasingly favoring sustainable mining practices, which could significantly impact the graphite market. The European Union has introduced stringent regulations aimed at minimizing the environmental impact of mining activities. These regulations encourage companies to adopt eco-friendly practices, such as reducing carbon emissions and improving waste management. As a result, the graphite market may witness a shift towards more sustainable sourcing of graphite, potentially increasing operational costs but enhancing brand reputation. Companies that align with these regulations may gain a competitive edge, as consumers and investors increasingly prioritize sustainability in their purchasing decisions.