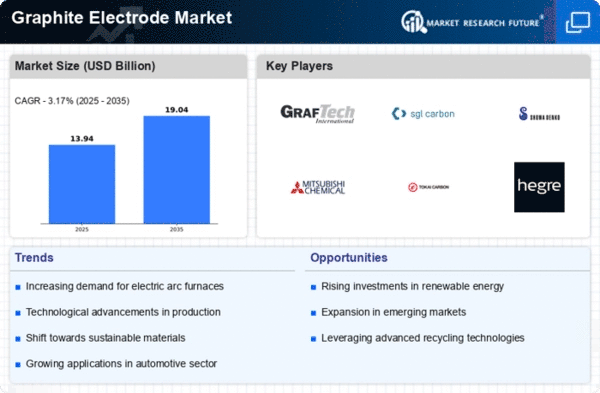

The Graphite Electrode Market is currently characterized by a dynamic competitive landscape, driven by increasing demand from the steel and aluminum industries, as well as the growing adoption of electric arc furnaces (EAFs). Key players such as GrafTech International Holdings Inc. (US), SGL Carbon SE (DE), and

Showa Denko K.K. (JP) are strategically positioning themselves through innovation and regional expansion. GrafTech, for instance, focuses on enhancing its production capabilities and product quality, while SGL Carbon emphasizes sustainability in its operations. These strategies collectively shape a competitive environment that is increasingly focused on technological advancement and environmental responsibility.In terms of business tactics, companies are localizing manufacturing to reduce lead times and optimize supply chains. The market structure appears moderately fragmented, with several players vying for market share. However, the collective influence of major companies like Mitsubishi Chemical Corporation (JP) and Tokai Carbon Co., Ltd. (JP) is notable, as they leverage their extensive networks and resources to maintain competitive advantages.

In November

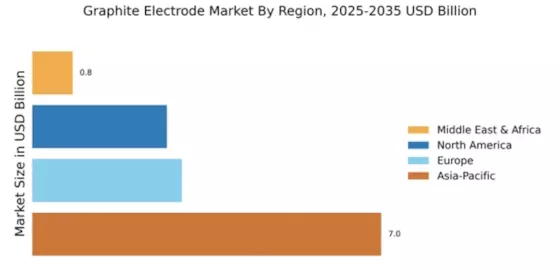

GrafTech International Holdings Inc. (US) announced the expansion of its manufacturing facility in Ohio, aimed at increasing production capacity by 30%. This strategic move is likely to enhance its market position by meeting the rising demand for high-quality graphite electrodes, particularly in North America. The expansion reflects GrafTech's commitment to innovation and operational efficiency, which are critical in a market that is increasingly competitive.

In October SGL Carbon SE (DE) launched a new line of eco-friendly graphite electrodes, which are produced using sustainable materials and processes. This initiative not only aligns with global sustainability trends but also positions SGL Carbon as a leader in environmentally conscious manufacturing. The introduction of these products may attract customers who prioritize sustainability, thereby enhancing the company's market share.

In September Showa Denko K.K. (JP) entered into a strategic partnership with a leading electric vehicle manufacturer to supply specialized graphite electrodes for battery production. This collaboration is indicative of Showa Denko's forward-thinking approach, as it diversifies its application of graphite electrodes beyond traditional markets. Such partnerships may pave the way for new revenue streams and reinforce the company's competitive edge in emerging sectors.

As of December current competitive trends in the Graphite Electrode Market are heavily influenced by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming increasingly important, as companies seek to enhance their capabilities and market reach. The shift from price-based competition to a focus on innovation, technology, and supply chain reliability is evident. Moving forward, differentiation will likely hinge on the ability to adapt to these trends, with companies that prioritize technological advancements and sustainable practices poised to lead the market.