Germany : Strong Demand and Innovation Hub

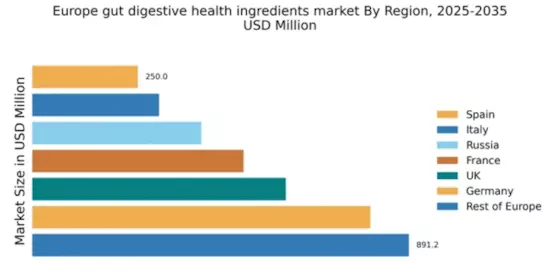

Germany holds a dominant position in the European gut digestive-health-ingredients market, accounting for 800.0 million, representing approximately 25% of the total market share. Key growth drivers include a rising health consciousness among consumers, increased demand for probiotics, and a robust regulatory framework supporting health claims. Government initiatives promoting gut health awareness and investment in research and development further bolster market growth. The country’s advanced infrastructure facilitates efficient distribution and manufacturing processes.

UK : Consumer Awareness Fuels Growth

The UK market for gut digestive-health ingredients is valued at 600.0 million, capturing around 19% of the European market. Growth is driven by increasing consumer awareness of gut health benefits and a shift towards natural ingredients. Regulatory support from the Food Standards Agency ensures compliance with health claims, while the rise of e-commerce enhances product accessibility. The market is characterized by a diverse range of products, including functional foods and supplements, catering to various consumer needs.

France : Focus on Natural Ingredients

France's gut digestive-health-ingredients market is valued at 500.0 million, representing about 16% of the European market. The growth is propelled by a strong preference for organic and natural products, alongside increasing awareness of digestive health. Regulatory frameworks, such as the European Food Safety Authority guidelines, support product innovation. The market is witnessing a surge in demand for plant-based probiotics and functional foods, reflecting changing consumer preferences.

Russia : Market Potential on the Rise

Russia's market for gut digestive-health ingredients is valued at 400.0 million, accounting for approximately 12% of the European market. Key growth drivers include a rising middle class and increasing health awareness. Government initiatives aimed at improving food safety and health standards are fostering a conducive environment for market growth. The demand for probiotics and dietary supplements is on the rise, particularly in urban areas like Moscow and St. Petersburg, where health trends are gaining traction.

Italy : Traditional Diet Meets Modern Needs

Italy's gut digestive-health-ingredients market is valued at 300.0 million, representing about 9% of the European market. The growth is driven by a cultural shift towards health and wellness, with consumers increasingly seeking functional foods. Regulatory support from the Italian Ministry of Health encourages innovation in health claims. The competitive landscape features local players alongside international brands, with key markets in cities like Milan and Rome, where health trends are particularly pronounced.

Spain : Health Trends Reshape Market Dynamics

Spain's market for gut digestive-health ingredients is valued at 250.0 million, capturing around 8% of the European market. The growth is fueled by increasing consumer interest in probiotics and digestive wellness. Regulatory frameworks support health claims, while local initiatives promote awareness of gut health. The market is characterized by a mix of traditional and modern products, with significant activity in regions like Catalonia and Madrid, where health-conscious consumers are driving demand.

Rest of Europe : Varied Consumer Preferences Across Regions

The Rest of Europe market for gut digestive-health ingredients is valued at 891.2 million, representing approximately 28% of the total market. This diverse region showcases varied consumer preferences, with significant growth in Eastern European countries driven by increasing health awareness. Regulatory bodies across different nations are enhancing food safety standards, fostering innovation. Key players like DuPont and BASF are expanding their presence, catering to local demands for functional foods and supplements.