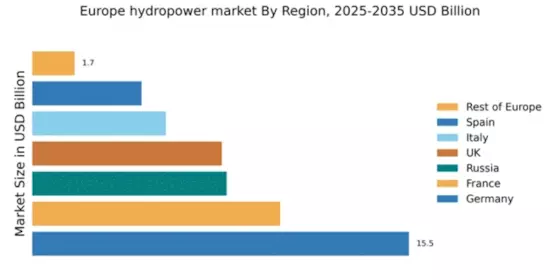

Germany : Strong Infrastructure and Investment Climate

Key markets include Bavaria and Baden-Württemberg, where hydropower plants are abundant. The competitive landscape features major players like E.ON SE and China Three Gorges Corporation, which are actively expanding their portfolios. Local dynamics are favorable, with a strong emphasis on sustainability and environmental protection. Industries such as manufacturing and technology are increasingly relying on hydropower, further solidifying its role in Germany's energy mix.

UK : Focus on Sustainable Energy Solutions

Key markets include Scotland and Wales, where numerous small-scale hydropower projects are operational. The competitive landscape features players like Duke Energy Corporation and Fortum Oyj, focusing on innovative solutions. The local business environment is increasingly supportive of green energy initiatives, with a growing emphasis on community-based projects. Hydropower is being integrated into various sectors, including agriculture and tourism, enhancing its market relevance.

France : Diverse Energy Mix and Innovation

Key markets include the Auvergne-Rhône-Alpes and Provence-Alpes-Côte d'Azur regions, where significant hydropower facilities are located. Major players like Electricité de France dominate the landscape, focusing on modernization and efficiency. The competitive environment is characterized by a mix of large utilities and smaller independent producers. Hydropower applications span various sectors, including agriculture and urban development, contributing to France's energy independence.

Russia : Strategic Investments in Energy Sector

Key markets include Siberia and the Far East, where vast hydropower potential remains untapped. RusHydro is a significant player, leading in capacity and innovation. The competitive landscape is evolving, with both state-owned and private entities investing in new projects. Local dynamics favor large-scale hydropower plants, which are crucial for regional development and energy supply, particularly in industrial sectors.

Italy : Investment in Renewable Energy Sources

Key markets include the northern regions of Lombardy and Trentino-Alto Adige, where hydropower plants are prevalent. Major players like Enel Green Power are actively expanding their operations. The competitive landscape features a mix of large utilities and smaller independent producers. Hydropower applications are diverse, serving sectors such as agriculture, tourism, and manufacturing, enhancing Italy's energy diversification efforts.

Spain : Focus on Renewable Energy Transition

Key markets include the regions of Galicia and Andalusia, where significant hydropower installations exist. The competitive landscape features players like Endesa and Iberdrola, focusing on sustainability and innovation. Local dynamics are favorable, with a strong emphasis on community engagement in renewable projects. Hydropower applications are expanding into sectors such as agriculture and urban development, reinforcing Spain's commitment to a sustainable energy future.

Rest of Europe : Diverse Opportunities Across Regions

Key markets include smaller nations like Austria and Switzerland, where hydropower is integral to the energy mix. The competitive landscape features a mix of local and international players, focusing on innovative solutions. Local dynamics are characterized by a strong commitment to sustainability and environmental protection. Hydropower applications are diverse, serving sectors such as tourism and agriculture, enhancing energy security across the region.