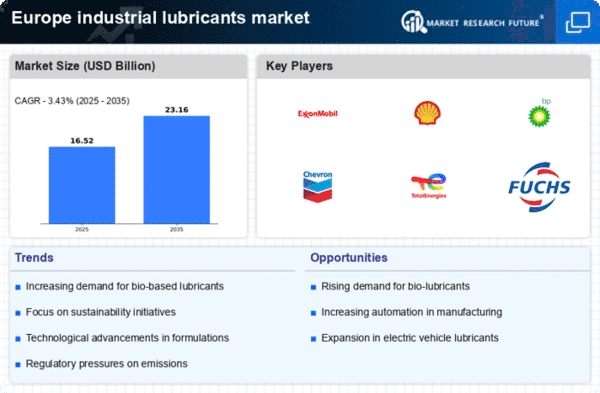

Regulatory Compliance Pressure

The industrial lubricants market in Europe is increasingly influenced by stringent regulatory frameworks aimed at reducing environmental impact. Regulations such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) compel manufacturers to ensure that their products meet safety and environmental standards. This compliance pressure drives innovation in the formulation of lubricants, pushing companies to develop eco-friendly alternatives. As a result, the market is witnessing a shift towards biodegradable and non-toxic lubricants, which are expected to capture a larger share of the market. In 2025, it is projected that eco-friendly lubricants could account for approximately 30% of the total industrial lubricants market in Europe, reflecting a growing consumer preference for sustainable products.

Shift Towards Renewable Energy Sources

The industrial lubricants market in Europe is experiencing a notable shift due to the increasing adoption of renewable energy sources. As industries transition towards sustainability, there is a growing need for lubricants that can perform efficiently under varying conditions associated with renewable energy applications, such as wind turbines and solar panels. This transition is expected to drive demand for specialized lubricants that can withstand extreme temperatures and environmental conditions. By 2025, it is projected that lubricants tailored for renewable energy applications could account for approximately 15% of the overall industrial lubricants market in Europe. This shift not only reflects changing energy paradigms but also highlights the evolving requirements of lubricant formulations.

Increased Focus on Equipment Efficiency

The industrial lubricants market in Europe is significantly influenced by the heightened focus on equipment efficiency and operational reliability. Industries are increasingly recognizing the importance of using high-quality lubricants to minimize friction and wear, thereby extending the lifespan of machinery. This focus is particularly evident in sectors such as manufacturing and transportation, where equipment downtime can lead to substantial financial losses. As a result, there is a growing trend towards the use of premium lubricants that offer enhanced performance and protection. In 2025, it is anticipated that the demand for high-performance lubricants will rise, potentially capturing around 35% of the industrial lubricants market in Europe. This trend underscores the critical role of lubricants in maintaining operational efficiency.

Rising Demand from Manufacturing Sector

The industrial lubricants market in Europe is significantly driven by the robust growth of the manufacturing sector. As industries such as automotive, aerospace, and machinery continue to expand, the demand for high-performance lubricants is on the rise. In 2025, the manufacturing sector is anticipated to contribute nearly 40% of the total lubricant consumption in Europe. This growth is attributed to the need for enhanced efficiency and reduced downtime in manufacturing processes. Consequently, manufacturers are increasingly investing in advanced lubricants that offer superior performance, longevity, and protection against wear and tear. This trend indicates a strong correlation between manufacturing growth and lubricant demand, positioning the industrial lubricants market for sustained expansion.

Technological Innovations in Lubricant Formulation

Technological advancements play a pivotal role in shaping the industrial lubricants market in Europe. Innovations in lubricant formulation, such as the development of nanotechnology-based lubricants, are enhancing performance characteristics. These advanced lubricants offer improved thermal stability, reduced friction, and extended service life, which are critical for high-demand applications. The integration of smart technologies, such as IoT-enabled monitoring systems, is also gaining traction, allowing for real-time performance tracking and predictive maintenance. As industries seek to optimize operations and reduce costs, the adoption of these innovative lubricants is likely to increase. By 2025, it is estimated that technologically advanced lubricants could represent around 25% of the industrial lubricants market in Europe.