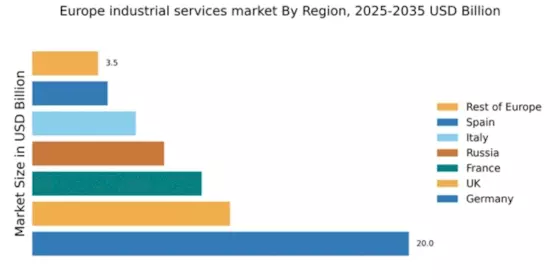

Germany : Strong Growth Driven by Innovation

Germany holds a commanding 20.0% market share in the European industrial services sector, valued at approximately €50 billion. Key growth drivers include a robust manufacturing base, increasing automation, and a strong push towards Industry 4.0. Demand trends show a shift towards smart technologies and sustainable practices, supported by government initiatives like the "Industrie 4.0" strategy. Infrastructure investments in transportation and energy are also pivotal for industrial development.

UK : Diverse Industries Fuel Growth

The UK accounts for 10.5% of the European industrial services market, valued at around €25 billion. Growth is driven by sectors such as aerospace, automotive, and renewable energy. Demand for advanced manufacturing solutions is rising, alongside government support for green technologies. Regulatory frameworks are evolving to enhance sustainability and innovation, fostering a conducive environment for industrial services.

France : Strong Regulatory Support for Growth

France captures 9.0% of the European market, valued at approximately €22 billion. The growth is propelled by investments in renewable energy and smart manufacturing. Demand for energy-efficient solutions is increasing, supported by government policies aimed at reducing carbon emissions. The French government’s "France 2030" plan emphasizes innovation and sustainability, driving industrial service demand.

Russia : Resource-Rich Economy Drives Demand

Russia holds a 7.0% share of the European industrial services market, valued at about €15 billion. Key growth drivers include the oil and gas sector, which demands advanced industrial services. The government is investing in infrastructure and modernization initiatives, aiming to enhance industrial capabilities. Demand trends indicate a growing interest in automation and digitalization across various sectors.

Italy : Heritage Meets Modern Innovation

Italy represents 5.5% of the European market, valued at around €12 billion. The industrial services sector is bolstered by a strong manufacturing heritage, particularly in machinery and automotive. Growth is driven by innovation in design and production processes, supported by government initiatives promoting digital transformation. Demand for high-quality, customized solutions is on the rise, reflecting changing consumption patterns.

Spain : Investment in Infrastructure and Technology

Spain accounts for 4.0% of the European industrial services market, valued at approximately €10 billion. Key growth drivers include investments in renewable energy and infrastructure development. The government is actively promoting industrial modernization through various initiatives, enhancing the business environment. Demand for automation and smart technologies is increasing, particularly in sectors like construction and manufacturing.

Rest of Europe : Varied Markets with Unique Needs

The Rest of Europe holds a 3.5% market share, valued at around €8 billion. This sub-region encompasses a variety of markets, each with distinct industrial service needs. Growth is driven by localized demand for tailored solutions, influenced by regional economic conditions and regulatory frameworks. Countries like Belgium and the Netherlands are emerging as key players, focusing on sustainability and innovation in industrial services.

Leave a Comment