Industrial Automation Services Market Summary

As per Market Research Future analysis, the Industrial Automation Services Market Size was estimated at 165.89 USD Billion in 2024. The Industrial Automation Services industry is projected to grow from 189.44 USD Billion in 2025 to 714.73 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 14.2% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Industrial Automation Services Market is experiencing robust growth driven by technological advancements and increasing demand for efficiency.

- The integration of Artificial Intelligence is transforming operational processes across various industries.

- Cybersecurity has become a critical focus as companies seek to protect their automated systems from potential threats.

- Customization is increasingly prioritized, allowing businesses to tailor solutions to their specific needs and challenges.

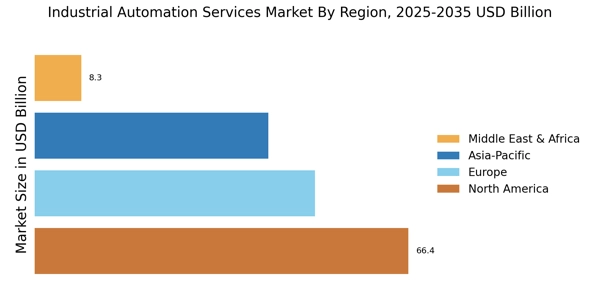

- Rising demand for efficiency and technological advancements are key drivers, particularly in North America and Asia-Pacific, with PLCs leading the market and MES showing rapid growth.

Market Size & Forecast

| 2024 Market Size | 165.89 (USD Billion) |

| 2035 Market Size | 714.73 (USD Billion) |

| CAGR (2025 - 2035) | 14.2% |

Major Players

Siemens (DE), Rockwell Automation (US), Schneider Electric (FR), Honeywell (US), ABB (CH), Emerson Electric (US), Mitsubishi Electric (JP), Yokogawa Electric (JP), General Electric (US)