Government Initiatives and Policies

The Indian government is actively promoting the industrial automation-services market through various initiatives and policies. Programs such as 'Make in India' and 'Digital India' aim to enhance manufacturing capabilities and encourage the adoption of automation technologies. These initiatives provide financial incentives and support for companies investing in automation solutions. Furthermore, the government is focusing on developing smart cities, which necessitates advanced automation services for infrastructure management. As a result, the market is likely to witness increased investments, with projections indicating a growth rate of around 15% annually over the next five years. This supportive regulatory environment is crucial for the expansion of the industrial automation-services market.

Rising Labor Costs and Skill Shortages

The industrial automation-services market in India is also influenced by rising labor costs and a shortage of skilled labor. As wages continue to increase, companies are compelled to seek automation solutions to maintain profitability. Additionally, the scarcity of skilled workers in technical fields further drives the need for automation. Businesses are increasingly investing in automated systems to mitigate these challenges, which can lead to a reduction in labor dependency by approximately 20%. This shift not only addresses cost concerns but also enhances operational reliability. Consequently, the industrial automation-services market is likely to expand as organizations prioritize automation to counteract labor-related issues.

Technological Advancements in Automation

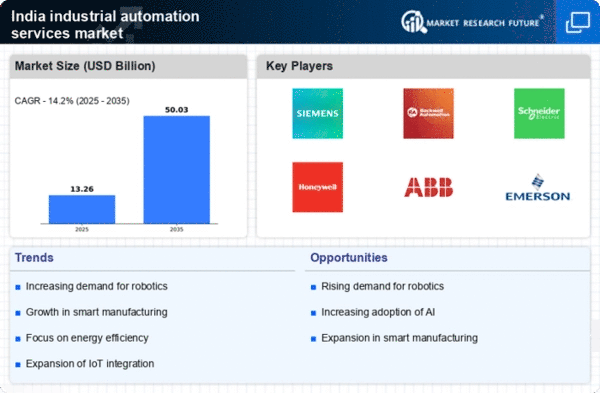

The industrial automation-services market in India is experiencing a surge due to rapid technological advancements. Innovations in robotics, artificial intelligence, and machine learning are transforming traditional manufacturing processes. These technologies enhance efficiency, reduce operational costs, and improve product quality. For instance, the integration of AI in automation systems can lead to a reduction in downtime by up to 30%. As companies increasingly adopt these technologies, the demand for automation services is expected to grow significantly. The market is projected to reach a valuation of approximately $5 billion by 2026, indicating a robust growth trajectory. This trend suggests that businesses are prioritizing automation to remain competitive in a fast-evolving industrial landscape.

Growing Demand for Operational Efficiency

In the context of the industrial automation-services market, there is a pronounced demand for operational efficiency among Indian manufacturers. Companies are increasingly recognizing that automation can streamline processes, reduce waste, and enhance productivity. The push for efficiency is driven by the need to remain competitive in both domestic and international markets. Reports suggest that organizations implementing automation solutions can achieve productivity gains of up to 25%. This trend is particularly evident in sectors such as automotive and pharmaceuticals, where precision and speed are paramount. As manufacturers seek to optimize their operations, the industrial automation-services market is poised for substantial growth, with an expected market size of $4 billion by 2025.

Increased Focus on Quality and Compliance

Quality assurance and regulatory compliance are becoming critical drivers in the industrial automation-services market. Indian manufacturers are under pressure to meet stringent quality standards and regulatory requirements, particularly in sectors such as food and pharmaceuticals. Automation technologies facilitate real-time monitoring and control, ensuring that production processes adhere to quality benchmarks. This focus on quality is expected to propel the market, as companies invest in automation solutions that enhance traceability and compliance. The market is anticipated to grow at a rate of 12% annually, reflecting the increasing importance of quality management in manufacturing. As such, the industrial automation-services market is likely to see a surge in demand for advanced automation systems.