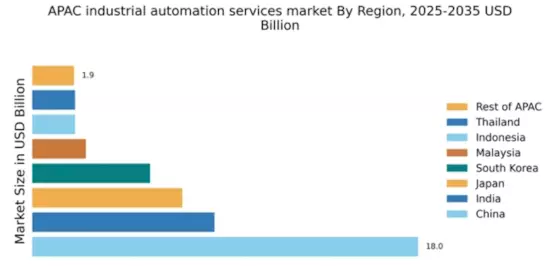

China : Rapid Growth and Innovation Hub

Key markets include major cities like Shanghai, Beijing, and Shenzhen, which are witnessing significant industrial activity. the competitive landscape features major players like Siemens, Rockwell Automation, and Mitsubishi Electric, all competing for market share.. Local dynamics are characterized by a mix of state-owned enterprises and private firms, creating a diverse business environment. Industries such as automotive, electronics, and pharmaceuticals are leading the demand for automation services.

India : Diverse Industries Driving Growth

Key markets include Maharashtra, Tamil Nadu, and Gujarat, which are industrial hubs with a high concentration of manufacturing units. The competitive landscape features players like Siemens, Schneider Electric, and Rockwell Automation, all actively investing in local operations. The business environment is evolving, with increasing collaboration between technology providers and manufacturers. Sectors such as textiles, food processing, and pharmaceuticals are significant consumers of automation services.

Japan : Advanced Automation Solutions Provider

Key markets include Tokyo, Osaka, and Nagoya, which are centers for advanced manufacturing and technology. The competitive landscape is dominated by local giants like Mitsubishi Electric and Fanuc, alongside international players like ABB and Honeywell. The business environment is characterized by high standards of quality and precision. Key sectors include automotive, electronics, and machinery, where automation services are increasingly integrated into production processes.

South Korea : Innovation and Investment in Automation

Key markets include Seoul, Busan, and Incheon, which are pivotal for industrial activities. The competitive landscape features major players like Siemens, Rockwell Automation, and local firms such as LG and Samsung. The business environment is robust, with a strong emphasis on R&D and collaboration between industry and academia. Key sectors include electronics, automotive, and shipbuilding, where automation is critical for maintaining global competitiveness.

Malaysia : Strategic Location for Manufacturing

Key markets include Selangor, Penang, and Johor, which are known for their industrial parks and manufacturing facilities. The competitive landscape features players like Siemens, Schneider Electric, and local firms. The business environment is conducive to growth, with increasing collaboration between local manufacturers and technology providers. Key sectors include electronics, automotive, and food processing, where automation services are becoming essential for operational efficiency.

Thailand : Investment in Manufacturing Growth

Key markets include Bangkok, Chonburi, and Rayong, which are industrial centers with a high concentration of manufacturing activities. The competitive landscape features major players like Siemens, Rockwell Automation, and local firms. The business environment is evolving, with increasing foreign investment and collaboration between local and international companies. Key sectors include automotive, electronics, and food processing, where automation is critical for maintaining competitiveness.

Indonesia : Diverse Market with Growth Potential

Key markets include Jakarta, Surabaya, and Bandung, which are vital for industrial activities. The competitive landscape features players like Siemens, Schneider Electric, and local firms. The business environment is characterized by a mix of local and international companies, fostering innovation and collaboration. Key sectors include textiles, food processing, and automotive, where automation services are becoming increasingly important for operational efficiency.

Rest of APAC : Varied Growth Across Sub-regions

Key markets include emerging economies like Vietnam, Philippines, and Bangladesh, which are witnessing growth in manufacturing activities. The competitive landscape is characterized by a mix of local and international players, including Siemens and Rockwell Automation. The business environment varies significantly, with some countries experiencing rapid industrialization while others are still developing their automation capabilities. Key sectors include textiles, electronics, and food processing, where automation is increasingly recognized as a driver of growth.