Growing Emphasis on Data Analytics

The growing emphasis on data analytics is a crucial driver for the IoT integration market in Europe. Organizations are increasingly recognizing the value of data generated by IoT devices, leading to a surge in demand for analytics solutions that can derive actionable insights. The European data analytics market is expected to reach €50 billion by 2025, with IoT data analytics playing a significant role in this growth. Companies are investing in IoT integration to harness the power of big data, enabling them to optimize operations, enhance customer experiences, and drive innovation. This trend indicates a shift towards data-driven decision-making, further solidifying the importance of IoT integration.

Regulatory Support for IoT Innovations

Regulatory frameworks in Europe are increasingly supportive of IoT innovations, acting as a significant driver for the IoT integration market. The European Union has introduced various initiatives aimed at fostering digital transformation, including the Digital Single Market strategy. This regulatory environment encourages businesses to adopt IoT solutions, as compliance with standards can enhance operational efficiency and competitiveness. For instance, the EU's General Data Protection Regulation (GDPR) has prompted organizations to integrate IoT technologies that prioritize data privacy and security. As a result, the market is expected to grow by 20% annually, driven by the need for compliant IoT solutions that align with regulatory requirements.

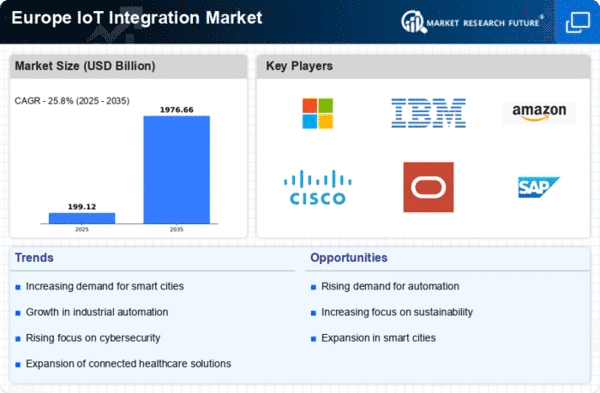

Rising Demand for Smart Infrastructure

The increasing demand for smart infrastructure in Europe is a pivotal driver for the IoT integration market. As urbanization accelerates, cities are seeking innovative solutions to enhance efficiency and sustainability. The European Commission has set ambitious targets for smart city initiatives, aiming to reduce carbon emissions by 55% by 2030. This push for smart infrastructure necessitates the integration of IoT technologies, enabling real-time data collection and analysis. Consequently, investments in IoT integration are projected to reach €100 billion by 2026, reflecting a compound annual growth rate (CAGR) of 25%. This trend underscores the critical role of IoT in transforming urban environments and improving the quality of life for residents.

Advancements in Connectivity Technologies

Advancements in connectivity technologies are propelling the IoT integration market in Europe. The rollout of 5G networks is particularly noteworthy, as it offers enhanced speed, lower latency, and greater capacity for connected devices. This technological evolution enables more robust IoT applications across various sectors, including healthcare, manufacturing, and transportation. According to industry estimates, the number of connected devices in Europe is projected to exceed 1 billion by 2025, driven by the capabilities of 5G. This surge in connectivity is likely to stimulate demand for IoT integration services, as businesses seek to leverage the full potential of their connected ecosystems.

Increased Investment in Smart Manufacturing

Increased investment in smart manufacturing is emerging as a vital driver for the IoT integration market in Europe. The manufacturing sector is undergoing a digital transformation, with companies adopting IoT technologies to enhance productivity and efficiency. The European manufacturing industry is projected to invest over €200 billion in IoT solutions by 2027, reflecting a growing recognition of the benefits of smart factories. This investment is likely to facilitate the integration of IoT systems that enable real-time monitoring, predictive maintenance, and supply chain optimization. As manufacturers strive to remain competitive in a rapidly evolving market, the demand for IoT integration services is expected to rise significantly.