Advancements in Data Analytics

The iot integration market is being propelled by advancements in data analytics technologies. As organizations in the UK increasingly recognize the value of data-driven decision-making, the integration of IoT devices with sophisticated analytics platforms becomes crucial. The market for data analytics in the UK is projected to reach £3 billion by 2026, indicating a robust growth trajectory. This integration allows businesses to derive actionable insights from vast amounts of data generated by IoT devices, leading to improved operational efficiency and customer satisfaction. Consequently, the iot integration market is likely to benefit from this trend, as companies invest in analytics capabilities to harness the full potential of their IoT ecosystems.

Increased Focus on Sustainability

Sustainability has emerged as a critical driver for the iot integration market in the UK. As environmental concerns gain prominence, organizations are increasingly seeking IoT solutions that contribute to sustainable practices. The integration of IoT technologies enables real-time monitoring of energy consumption, waste management, and resource utilization, thereby facilitating more sustainable operations. A report indicates that 70% of UK businesses are prioritizing sustainability in their strategic planning, which is likely to boost the demand for IoT solutions that align with these goals. The iot integration market stands to benefit as companies adopt IoT technologies to enhance their sustainability efforts and meet regulatory requirements.

Government Initiatives and Support

Government initiatives play a pivotal role in shaping the iot integration market in the UK. The UK government has launched several programs aimed at fostering innovation and supporting the adoption of IoT technologies across various sectors. For instance, the Digital Strategy 2025 outlines plans to enhance digital infrastructure and promote IoT integration in industries such as healthcare, manufacturing, and agriculture. This proactive approach is expected to stimulate investment and collaboration between public and private sectors, thereby accelerating the growth of the iot integration market. With funding opportunities and regulatory support, businesses are encouraged to explore IoT solutions that can drive efficiency and competitiveness.

Rising Demand for Smart Infrastructure

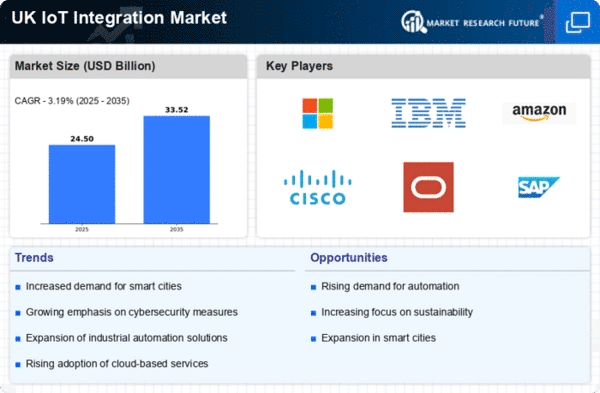

The iot integration market in the UK is experiencing a notable surge in demand for smart infrastructure solutions. This trend is driven by the increasing need for efficient energy management and resource optimization in urban areas. According to recent data, the UK government has committed to investing £12 billion in smart city initiatives by 2025, which is expected to significantly enhance the integration of IoT technologies. As cities evolve, the integration of IoT devices into public services, transportation, and utilities becomes essential. This shift not only improves operational efficiency but also enhances the quality of life for residents. The iot integration market is thus poised for substantial growth as municipalities seek to leverage technology for better governance and service delivery.

Growing Consumer Expectations for Connectivity

Consumer expectations for connectivity and seamless experiences are driving the iot integration market in the UK. As individuals become more accustomed to smart devices and interconnected systems, there is a rising demand for integrated solutions that enhance convenience and efficiency. The proliferation of smart home devices, wearables, and connected vehicles reflects this trend, with the market for smart home technology projected to reach £5 billion by 2027. This shift in consumer behavior compels businesses to invest in IoT integration to meet these expectations. Consequently, the iot integration market is likely to see increased activity as companies strive to deliver innovative and connected experiences to their customers.