Growing Focus on Sustainability

Sustainability has emerged as a critical concern for businesses and consumers in Europe, influencing the IoT platform market. Organizations are increasingly seeking IoT solutions that can help them monitor and reduce their environmental impact. For instance, IoT platforms that facilitate energy management and resource optimization are gaining traction as companies aim to meet sustainability targets. The European Commission has set ambitious goals to reduce greenhouse gas emissions by at least 55% by 2030, which is likely to drive demand for IoT technologies that support these objectives. As a result, the IoT platform market may witness a surge in interest from companies looking to implement sustainable practices through innovative IoT solutions.

Investment in Smart Infrastructure

The European Union's commitment to developing smart infrastructure is a significant catalyst for the IoT platform market. Initiatives aimed at modernizing transportation, energy, and urban development are driving investments in IoT technologies. For example, the EU has allocated over €100 billion for digital transformation projects, which include the deployment of IoT solutions. This investment is likely to enhance connectivity and efficiency in various sectors, creating a favorable environment for IoT platform providers. As cities and industries adopt smart technologies, the demand for integrated IoT platforms that can support these initiatives will likely increase. Consequently, the IoT platform market is poised for growth as stakeholders seek to capitalize on these advancements.

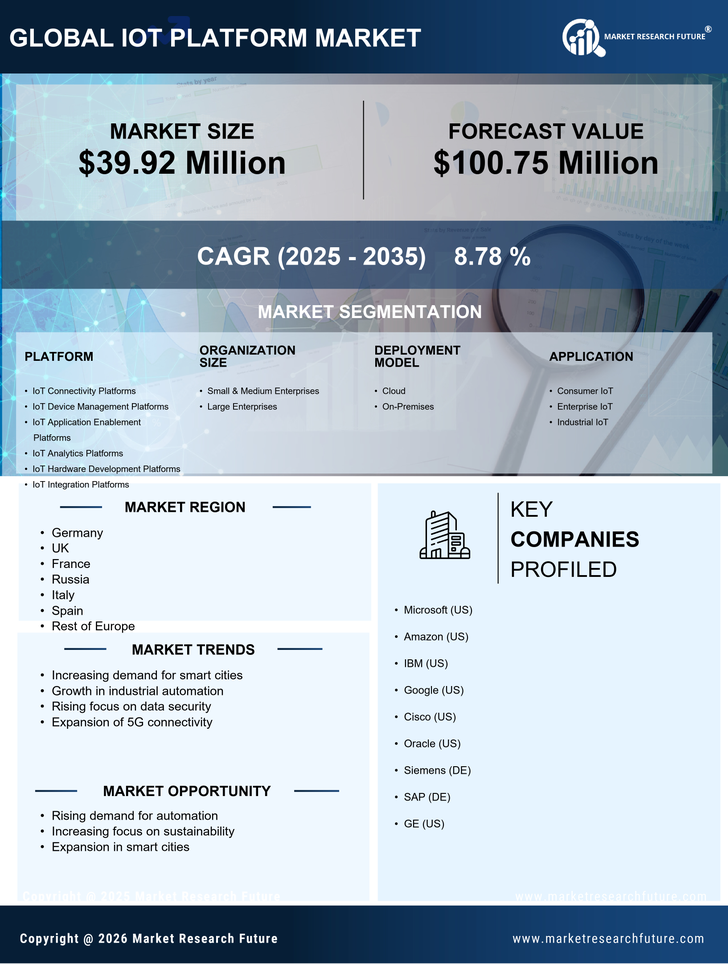

Increased Adoption of Smart Devices

The proliferation of smart devices across various sectors in Europe is a primary driver for the IoT platform market. As consumers and businesses increasingly adopt smart technologies, the demand for robust IoT platforms that can manage and integrate these devices grows. In 2025, it is estimated that the number of connected devices in Europe will reach approximately 1.5 billion, leading to a surge in data generation and necessitating advanced IoT solutions. This trend indicates a shift towards more interconnected environments, where IoT platforms play a crucial role in ensuring seamless communication and functionality among devices. Consequently, the IoT platform market is likely to experience substantial growth as organizations seek to leverage these technologies for enhanced operational efficiency and improved customer experiences.

Regulatory Compliance and Standards

The evolving regulatory landscape in Europe significantly impacts the IoT platform market. Governments are increasingly implementing regulations aimed at ensuring data privacy, security, and interoperability among IoT devices. For instance, the General Data Protection Regulation (GDPR) has set stringent guidelines for data handling, compelling businesses to adopt IoT platforms that comply with these standards. This regulatory pressure is expected to drive the market as organizations prioritize compliance to avoid hefty fines and reputational damage. Furthermore, adherence to these regulations may enhance consumer trust in IoT solutions, thereby fostering market growth. As a result, the demand for compliant IoT platforms is anticipated to rise, positioning the industry for continued expansion in the coming years.

Enhanced Connectivity through 5G Technology

The rollout of 5G technology across Europe is poised to revolutionize the IoT platform market. With its promise of higher speeds, lower latency, and greater capacity, 5G is expected to enable a new wave of IoT applications that require real-time data processing and communication. This technological advancement could facilitate the deployment of more sophisticated IoT solutions, particularly in sectors such as healthcare, manufacturing, and transportation. As 5G networks become more widespread, the demand for IoT platforms that can leverage this technology is likely to increase. Consequently, the IoT platform market may experience accelerated growth as businesses seek to harness the capabilities of 5G to enhance their operations and service offerings.