Regulatory Support for Recycling

The lead acid-battery market in Europe benefits from stringent regulations promoting recycling and waste management. The European Union has established directives that mandate the recycling of lead acid batteries, aiming for a recycling rate of at least 65%. This regulatory framework not only encourages manufacturers to adopt sustainable practices but also enhances the overall market by ensuring a steady supply of recycled materials. As a result, the industry is likely to see increased investment in recycling technologies, which could lead to cost reductions and improved environmental outcomes. Furthermore, the emphasis on circular economy principles aligns with consumer preferences for sustainable products, potentially boosting demand for lead acid batteries that are produced with recycled content.

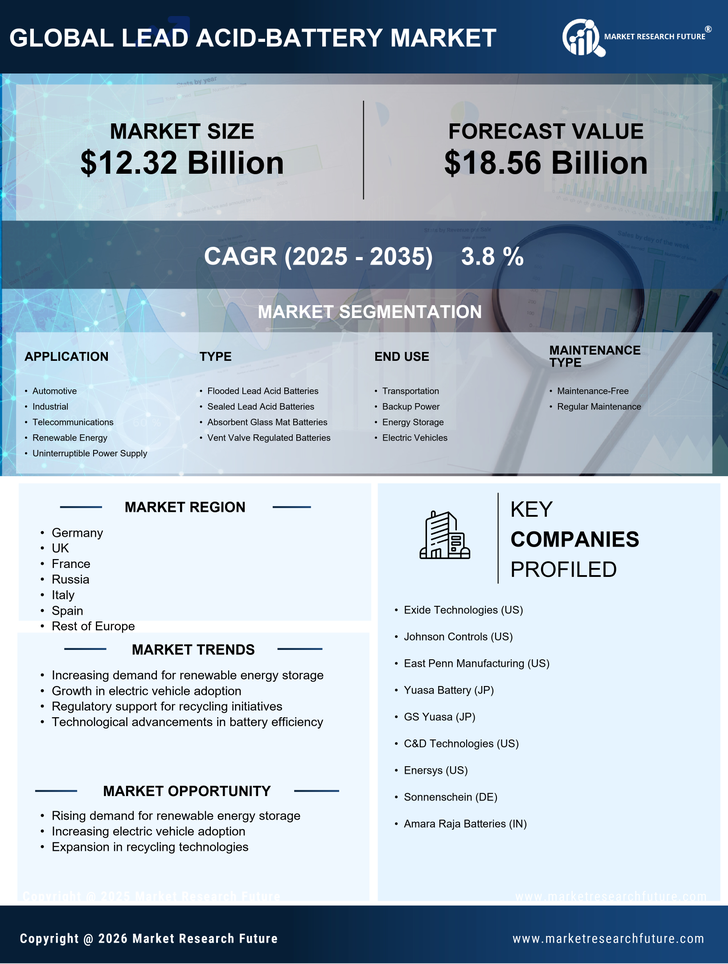

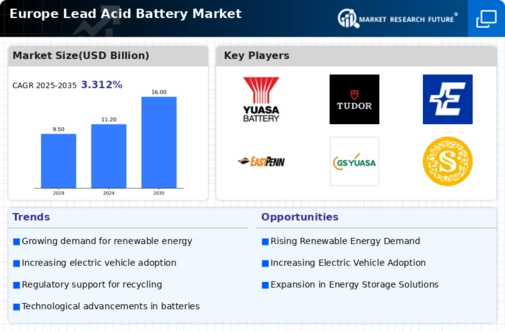

Growth in Renewable Energy Storage

The lead acid-battery market is experiencing a notable shift due to the increasing integration of renewable energy sources. As Europe aims to meet its ambitious climate goals, the demand for energy storage solutions is rising. Lead acid batteries, known for their reliability and cost-effectiveness, are being utilized in various renewable energy applications, such as solar and wind energy systems. The market for energy storage in Europe is projected to grow at a CAGR of approximately 15% over the next five years. This growth is likely to drive the demand for lead acid batteries, as they provide a viable solution for storing excess energy generated from renewable sources, thereby enhancing grid stability and energy security.

Rising Demand in Automotive Sector

The automotive sector plays a crucial role in shaping the lead acid-battery market in Europe. With the ongoing transition towards electric vehicles (EVs) and hybrid vehicles, lead acid batteries remain essential for starting, lighting, and ignition (SLI) applications. In 2025, it is estimated that the automotive segment will account for nearly 40% of the total lead acid battery consumption in Europe. This sustained demand is driven by the need for reliable power sources in vehicles, as well as the growing trend of vehicle electrification. Additionally, the affordability of lead acid batteries compared to alternative technologies makes them a preferred choice for many automotive manufacturers, further solidifying their position in the market.

Increased Focus on Energy Efficiency

The lead acid-battery market is witnessing a heightened focus on energy efficiency across various sectors. As businesses and consumers become more conscious of energy consumption, the demand for efficient energy storage solutions is rising. Lead acid batteries, known for their ability to deliver reliable power, are increasingly being adopted in applications that prioritize energy efficiency. This trend is particularly evident in industrial and commercial sectors, where lead acid batteries are utilized for backup power and energy management systems. The market is projected to grow as organizations seek to optimize their energy usage and reduce operational costs. Furthermore, government incentives aimed at promoting energy-efficient technologies may further bolster the adoption of lead acid batteries in Europe.

Technological Advancements in Battery Design

Technological innovations are significantly influencing the lead acid-battery market in Europe. Recent advancements in battery design, such as improved plate technology and enhanced electrolyte formulations, have led to increased efficiency and longevity of lead acid batteries. These innovations are crucial as they address the growing consumer demand for batteries that offer better performance and lower maintenance costs. The introduction of advanced lead acid batteries, which can provide higher energy density and faster charging capabilities, is expected to capture a larger market share. As manufacturers continue to invest in research and development, the overall competitiveness of lead acid batteries is likely to improve, making them more appealing in various applications, including renewable energy and automotive sectors.