Germany : Strong Demand and Innovation Hub

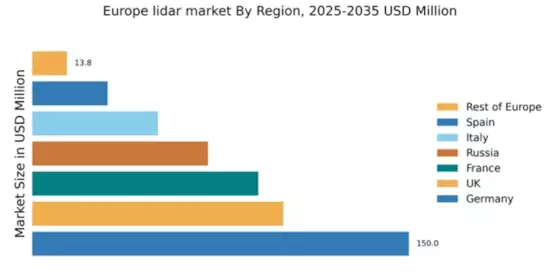

Germany holds a commanding market share of 150.0, representing a significant portion of the European lidar market. Key growth drivers include robust automotive manufacturing, increasing investments in smart city initiatives, and a strong focus on autonomous vehicle technology. Regulatory support, such as the German government's push for digital infrastructure, further fuels demand. The country is also witnessing a surge in industrial applications, particularly in logistics and manufacturing sectors.

UK : Innovation and Investment Surge

The UK accounts for a market share of 100.0, driven by advancements in automotive technology and increasing adoption of lidar in various sectors. Demand is bolstered by government initiatives aimed at enhancing transportation safety and efficiency. The UK government has also introduced funding programs to support research and development in autonomous systems, creating a favorable environment for lidar applications.

France : Focus on Smart Mobility Solutions

France's lidar market, valued at 90.0, is characterized by a strong emphasis on smart mobility and urban planning. The French government is actively promoting sustainable transport solutions, which drives demand for lidar technology in public transport and urban infrastructure projects. The market is also supported by significant investments in research and development, particularly in the automotive sector.

Russia : Focus on Defense and Infrastructure

With a market share of 70.0, Russia is gradually adopting lidar technology, particularly in defense and infrastructure projects. Government initiatives aimed at modernizing transportation networks and enhancing security are key growth drivers. The demand for lidar in urban planning and environmental monitoring is also on the rise, supported by regulatory frameworks promoting technological innovation.

Italy : Automotive Sector Driving Growth

Italy's lidar market, valued at 50.0, is primarily driven by the automotive sector, which is increasingly integrating lidar for advanced driver-assistance systems (ADAS). The Italian government is promoting initiatives to enhance road safety and reduce emissions, further boosting demand. Additionally, the country's rich automotive heritage fosters innovation and collaboration among key players in the lidar space.

Spain : Investment in Smart Technologies

Spain's lidar market, with a value of 30.0, is witnessing growth due to increased investments in smart technologies and urban mobility solutions. The Spanish government is focusing on sustainable transport initiatives, which are driving demand for lidar applications in public transport and logistics. The competitive landscape is evolving, with local startups emerging alongside established players.

Rest of Europe : Varied Applications Across Regions

The Rest of Europe, with a market value of 13.82, presents diverse opportunities for lidar technology across various sectors. Countries in this sub-region are increasingly adopting lidar for applications in agriculture, environmental monitoring, and urban planning. Local governments are implementing policies to support technological advancements, creating a conducive environment for market growth.