Expansion of Linux in Emerging Technologies

The Linux operating system market is poised for growth due to the expansion of Linux in emerging technologies such as artificial intelligence (AI), Internet of Things (IoT), and edge computing. These technologies require robust and adaptable operating systems, and Linux is well-suited to meet these demands. In Europe, the integration of Linux into IoT devices is particularly noteworthy, with a projected increase in Linux-based IoT deployments by 25% over the next few years. This trend is driven by the need for secure and efficient operating systems that can handle the complexities of interconnected devices. As organizations increasingly adopt Linux for these applications, the market is expected to expand, fostering innovation and collaboration within the industry.

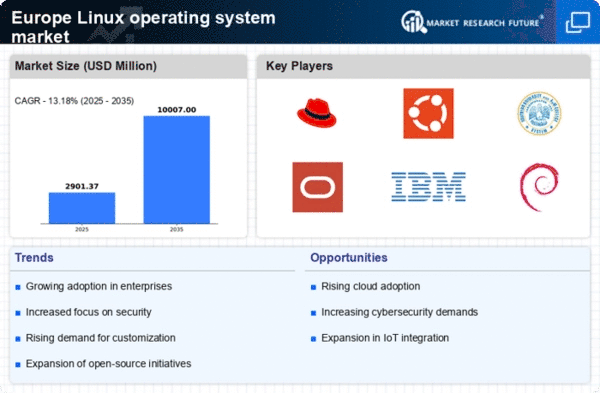

Increasing Adoption of Linux in Enterprises

The linux operating-system market in Europe is experiencing a notable shift as enterprises increasingly adopt Linux-based solutions. This trend is driven by the need for cost-effective and customizable operating systems that can be tailored to specific business requirements. According to recent data, approximately 30% of European enterprises have transitioned to Linux, highlighting its growing acceptance. The flexibility and scalability of Linux make it an attractive option for businesses looking to optimize their IT infrastructure. Furthermore, the ability to run Linux on various hardware platforms enhances its appeal, allowing organizations to leverage existing resources while minimizing costs. As more enterprises recognize the benefits of Linux, the market is likely to expand, fostering innovation and competition within the industry.

Growing Interest in Sustainable IT Solutions

Sustainability is becoming a key consideration for organizations across Europe, influencing the linux operating-system market. As businesses strive to reduce their carbon footprint and enhance energy efficiency, Linux emerges as a viable solution due to its lightweight nature and lower resource requirements. Studies suggest that Linux can reduce energy consumption by up to 20% compared to other operating systems, making it an attractive option for environmentally conscious organizations. Additionally, the open-source nature of Linux allows for community-driven improvements that can further enhance its sustainability profile. As the demand for sustainable IT solutions continues to rise, the linux operating-system market is likely to benefit from increased adoption among organizations committed to environmental responsibility.

Government Initiatives Supporting Open Source

Government initiatives across Europe are playing a crucial role in promoting the linux operating-system market. Various European governments have launched programs aimed at encouraging the adoption of open-source software, including Linux. These initiatives often include funding for research and development, as well as incentives for businesses to transition to open-source solutions. For instance, the European Commission has allocated significant resources to support open-source projects, which has led to an increase in Linux usage among public sector organizations. This support not only enhances the credibility of Linux but also drives its adoption in the private sector. As government backing continues, the linux operating-system market is expected to witness sustained growth, fostering a more robust ecosystem for developers and users alike.

Rising Demand for Customization and Flexibility

The Linux operating system market is significantly influenced by the rising demand for customization and flexibility among users in Europe. Organizations are increasingly seeking operating systems that can be tailored to their specific needs, and Linux offers unparalleled customization options. This demand is particularly evident in sectors such as education, healthcare, and finance, where specialized applications are essential. Recent surveys indicate that over 40% of European IT managers prioritize customization when selecting an operating system. The ability to modify the Linux kernel and utilize various distributions allows businesses to create solutions that align with their operational requirements. Consequently, this trend is likely to drive further adoption of Linux, as organizations recognize the advantages of a tailored approach to their IT infrastructure.

Leave a Comment