Shift Towards Cloud Computing

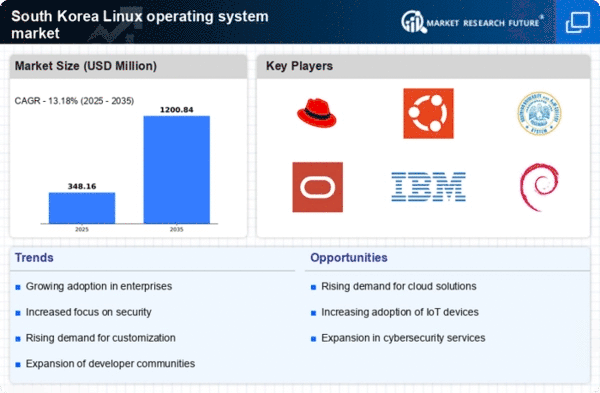

The transition to cloud computing significantly influences the linux operating-system market in South Korea. As organizations increasingly adopt cloud-based solutions, the need for compatible operating systems rises. Linux, known for its stability and scalability, is often the preferred choice for cloud environments. Recent statistics suggest that around 60% of cloud servers in South Korea run on Linux-based systems, highlighting its dominance in this sector. This shift not only enhances operational efficiency but also fosters a competitive landscape within the linux operating-system market, as providers innovate to offer robust cloud solutions.

Growing Demand for Customization

The Linux operating system market in South Korea experiences a notable increase in demand for customization options. Businesses and developers seek tailored solutions that align with their specific operational needs. This trend is particularly evident in sectors such as finance and telecommunications, where unique software configurations can enhance performance and security. According to recent data, approximately 45% of enterprises in South Korea express a preference for customizable operating systems, indicating a shift towards more flexible IT solutions. This growing demand for customization is likely to drive innovation within the linux operating-system market, as vendors strive to meet the diverse requirements of their clients.

Increased Focus on Cybersecurity

Cybersecurity concerns are paramount in the linux operating-system market, particularly in South Korea, where data breaches and cyber threats are prevalent. Organizations are increasingly prioritizing security features in their operating systems, leading to a surge in demand for Linux distributions known for their robust security protocols. Recent surveys indicate that over 70% of IT professionals in South Korea consider security a critical factor when selecting an operating system. This heightened focus on cybersecurity is likely to propel the linux operating-system market forward, as developers enhance security measures to protect sensitive data and maintain user trust.

Rising Interest in IoT Solutions

The proliferation of Internet of Things (IoT) devices is reshaping the linux operating-system market landscape in South Korea. As industries embrace IoT technologies, the need for lightweight and efficient operating systems becomes increasingly apparent. Linux, with its versatility and open-source nature, is well-suited for IoT applications. Current estimates suggest that the adoption of Linux in IoT devices could reach 50% by 2026, indicating a significant growth trajectory. This rising interest in IoT solutions is expected to drive innovation and expansion within the linux operating-system market, as developers create specialized distributions tailored for IoT environments.

Expansion of Open Source Communities

The growth of open source communities plays a pivotal role in shaping the linux operating-system market in South Korea. These communities foster collaboration and knowledge sharing, leading to the development of innovative solutions and enhancements. As more developers engage with open source projects, the quality and diversity of Linux distributions improve. Recent data indicates that participation in open source initiatives has increased by 30% in South Korea over the past year. This expansion of open source communities is likely to stimulate growth in the linux operating-system market, as organizations leverage community-driven innovations to enhance their IT infrastructure.

Leave a Comment