Rising Energy Storage Needs

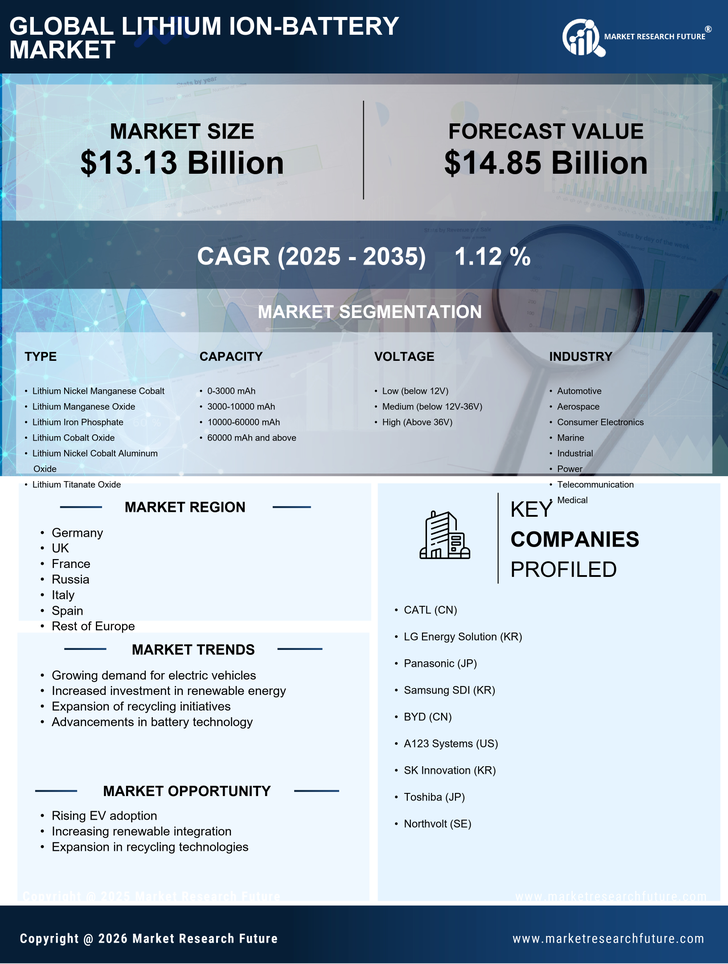

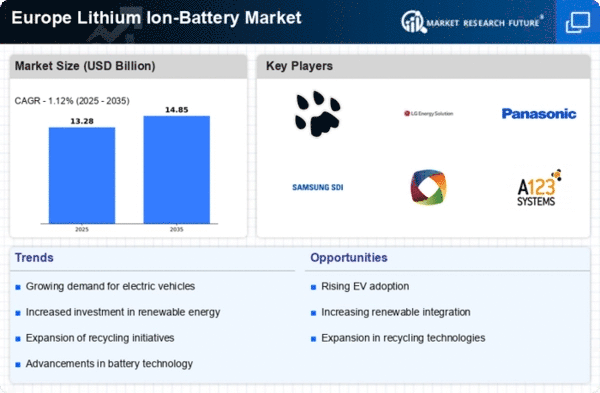

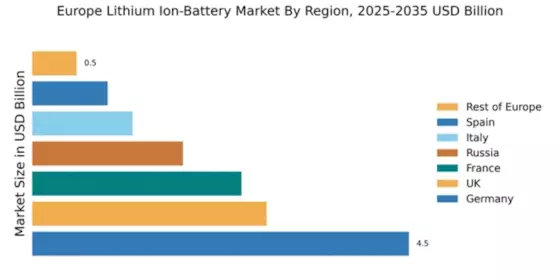

The increasing demand for energy storage solutions in Europe is a pivotal driver for the lithium ion-battery market. As renewable energy sources like wind and solar become more prevalent, the need for efficient energy storage systems intensifies. Lithium ion batteries are favored due to their high energy density and efficiency. In 2025, the energy storage market in Europe is projected to reach approximately €10 billion, with lithium ion batteries constituting a significant share. This trend indicates a robust growth trajectory for the lithium ion-battery market, as businesses and consumers alike seek reliable storage options to manage energy supply and demand fluctuations.

Government Incentives and Policies

European governments are increasingly implementing policies and incentives to promote the adoption of electric vehicles and renewable energy technologies. These initiatives often include subsidies, tax breaks, and grants aimed at reducing the cost of lithium ion batteries. For instance, the European Union has set ambitious targets for reducing carbon emissions, which indirectly boosts the lithium ion-battery market. In 2025, it is estimated that government incentives could account for up to 30% of the total market growth, encouraging manufacturers to innovate and expand their production capabilities.

Growing Consumer Electronics Market

The consumer electronics sector in Europe is experiencing robust growth, which is a crucial driver for the lithium ion-battery market. With the proliferation of smartphones, laptops, and wearable devices, the demand for compact and efficient batteries is surging. In 2025, the consumer electronics market is projected to reach €200 billion, with lithium ion batteries being the preferred choice due to their lightweight and high-performance characteristics. This trend suggests a sustained demand for lithium ion batteries, further solidifying their role in the market.

Shift Towards Renewable Energy Sources

The transition to renewable energy sources is a significant driver for the lithium ion-battery market in Europe. As countries strive to meet their climate goals, there is a marked increase in investments in solar and wind energy projects. Lithium ion batteries play a crucial role in this transition by providing the necessary storage solutions to balance supply and demand. By 2025, it is estimated that the integration of lithium ion batteries in renewable energy systems could enhance energy efficiency by up to 25%, thereby reinforcing their importance in the market.

Technological Innovations in Manufacturing

Advancements in manufacturing processes are significantly impacting the lithium ion-battery market in Europe. Innovations such as automated production lines and improved materials are enhancing battery performance and reducing costs. For example, the introduction of solid-state batteries is expected to revolutionize the market by offering higher energy densities and improved safety. As of 2025, the European lithium ion-battery market is anticipated to grow by 15% annually, driven by these technological advancements that enable manufacturers to produce batteries more efficiently and sustainably.