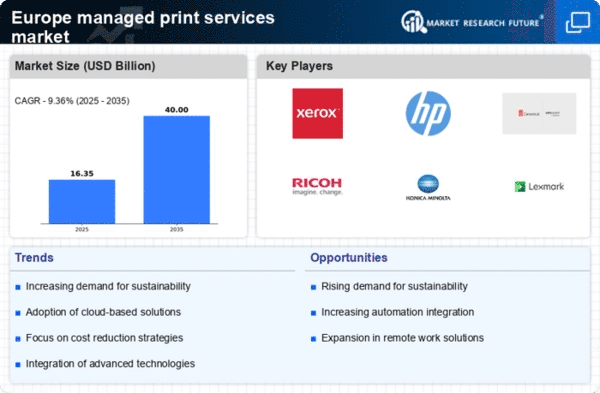

Cost Efficiency and Budget Management

The managed print-services market in Europe is increasingly driven by the need for cost efficiency and effective budget management. Organizations are seeking to reduce operational costs associated with printing, which can account for a substantial portion of their overall expenses. By outsourcing print services, companies can potentially save up to 30% on printing costs. This trend is particularly pronounced among small to medium-sized enterprises (SMEs) that often operate with tighter budgets. The managed print-services market provides tailored solutions that help businesses optimize their printing processes, reduce waste, and implement cost-effective strategies. As a result, organizations are more inclined to adopt managed print services to achieve financial sustainability and improve their bottom line.

Increased Demand for Remote Work Solutions

The rise of remote work has created a new dynamic in the managed print-services market in Europe. As more employees work from home, organizations are seeking solutions that facilitate efficient printing and document management outside traditional office environments. The managed print-services market is responding by offering remote printing solutions that allow employees to print securely from their home offices. This shift is likely to continue, as studies suggest that remote work is here to stay, with up to 30% of the workforce expected to remain remote in the long term. Consequently, businesses are increasingly investing in managed print services that cater to this evolving work landscape.

Regulatory Compliance and Security Concerns

Regulatory compliance and security concerns are paramount drivers in the managed print-services market in Europe. Organizations are increasingly aware of the need to protect sensitive information and adhere to stringent data protection regulations, such as the General Data Protection Regulation (GDPR). The managed print-services market offers solutions that ensure secure printing, document management, and data protection, which are essential for maintaining compliance. Companies that fail to address these concerns may face significant financial penalties and reputational damage. As a result, the demand for managed print services that prioritize security and compliance is on the rise, prompting businesses to invest in robust print management solutions.

Technological Advancements in Printing Solutions

Technological advancements are significantly influencing the managed print-services market in Europe. Innovations such as mobile printing, advanced scanning capabilities, and cloud-based solutions are reshaping how organizations approach their printing needs. The integration of artificial intelligence and machine learning into print management systems allows for enhanced efficiency and productivity. According to recent data, the adoption of these technologies can lead to a reduction in printing errors by up to 25%. As businesses strive to stay competitive, the managed print-services market is adapting to these technological changes, offering solutions that not only streamline operations but also enhance the overall user experience.

Environmental Sustainability and Eco-Friendly Practices

The managed print-services market in Europe is experiencing a notable shift towards environmental sustainability and eco-friendly practices. Organizations are increasingly recognizing the importance of reducing their carbon footprint and implementing sustainable printing solutions. The managed print-services market provides services that promote recycling, reduce paper waste, and utilize energy-efficient devices. Recent studies indicate that companies adopting these practices can reduce their paper consumption by up to 40%. This growing emphasis on sustainability not only aligns with corporate social responsibility goals but also appeals to environmentally conscious consumers, making it a crucial driver for the managed print-services market.