Cost Efficiency and Budget Control

The Managed Print Services MPS and Document Management Systems DMS Market is increasingly driven by the need for cost efficiency and budget control. Organizations are seeking ways to reduce operational costs associated with printing and document management. By implementing MPS, companies can achieve significant savings, with studies indicating potential reductions in printing costs by up to 30%. This financial incentive encourages businesses to adopt MPS solutions, which streamline printing processes and optimize resource allocation. Furthermore, the integration of DMS allows for better tracking of document usage and expenses, leading to more informed budgeting decisions. As organizations continue to prioritize cost management, the demand for MPS and DMS solutions is likely to grow, reflecting a broader trend towards financial prudence in business operations.

Regulatory Compliance and Data Security

The Managed Print Services MPS and Document Management Systems DMS Market is increasingly shaped by the need for regulatory compliance and data security. Organizations are facing stringent regulations regarding data protection and privacy, necessitating robust document management practices. MPS providers are responding by offering solutions that ensure secure printing and document handling, thereby mitigating risks associated with data breaches. Furthermore, DMS solutions often include features such as access controls and audit trails, which enhance compliance with legal requirements. As businesses prioritize data security and regulatory adherence, the demand for MPS and DMS solutions is expected to grow, reflecting a broader trend towards safeguarding sensitive information.

Environmental Sustainability Initiatives

In the current landscape, the Managed Print Services MPS and Document Management Systems DMS Market is influenced by a growing emphasis on environmental sustainability. Organizations are increasingly aware of their ecological footprint and are seeking solutions that align with sustainability goals. MPS providers often offer eco-friendly printing options, such as duplex printing and the use of recycled materials, which can significantly reduce paper waste. Additionally, DMS solutions facilitate digital document management, minimizing the need for physical storage and further decreasing environmental impact. As businesses strive to meet regulatory requirements and consumer expectations regarding sustainability, the adoption of MPS and DMS is expected to rise, reflecting a commitment to responsible resource management.

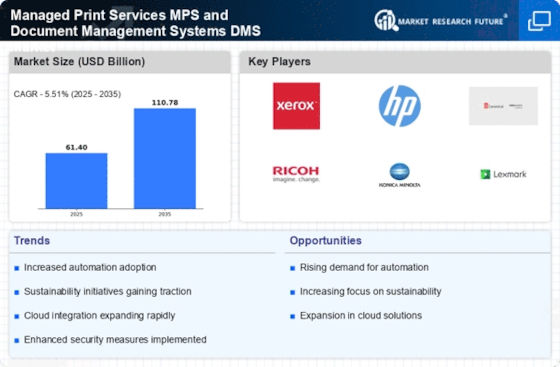

Technological Advancements and Automation

The Managed Print Services MPS and Document Management Systems DMS Market is significantly influenced by rapid technological advancements and automation. Innovations in printing technology, such as high-speed printers and multifunction devices, enhance the efficiency of print operations. Moreover, the integration of artificial intelligence and machine learning into DMS solutions allows for automated document processing and improved data management. These advancements not only streamline workflows but also reduce the time and resources required for document handling. As organizations seek to leverage technology to enhance productivity, the demand for MPS and DMS solutions is likely to increase, indicating a shift towards more automated and efficient business processes.

Shift Towards Remote Work and Digital Transformation

The Managed Print Services MPS and Document Management Systems DMS Market is experiencing a notable shift towards remote work and digital transformation. As organizations adapt to flexible work arrangements, the need for efficient document management and printing solutions becomes paramount. MPS providers are increasingly offering cloud-based services that enable remote printing and access to documents from various locations. Additionally, DMS solutions facilitate seamless collaboration among remote teams, allowing for efficient document sharing and editing. This transition towards digital workflows not only enhances productivity but also reduces reliance on physical resources. As the trend of remote work continues to evolve, the demand for MPS and DMS solutions is likely to increase, reflecting a fundamental change in how businesses operate.