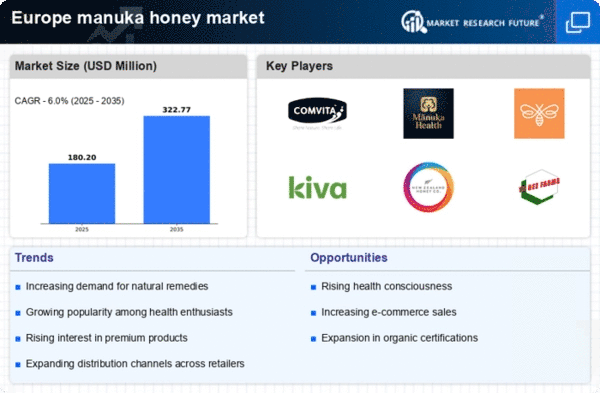

Expansion of Retail Channels

The expansion of retail channels is a crucial driver for the manuka honey market in Europe. Traditional retail outlets, alongside the rise of specialty health stores and online platforms, are enhancing the accessibility of manuka honey to consumers. The e-commerce sector, in particular, has witnessed remarkable growth, with online sales of health products increasing by approximately 25% in the last year. This shift in purchasing behavior is likely to continue, as consumers prefer the convenience of online shopping. Retailers are also investing in marketing strategies to promote manuka honey, highlighting its health benefits and unique qualities. As a result, the manuka honey market is expected to benefit from increased visibility and availability, ultimately driving sales and market penetration across Europe.

Growing Demand for Natural Remedies

The increasing inclination towards natural remedies is a pivotal driver for the manuka honey market in Europe. Consumers are becoming more aware of the health benefits associated with natural products, leading to a surge in demand for manuka honey, which is renowned for its antibacterial properties. According to recent data, the market for natural health products in Europe is projected to grow at a CAGR of approximately 8% over the next five years. This trend indicates a robust potential for the manuka honey market, as consumers seek alternatives to synthetic medications. Furthermore, the rise in chronic health issues has prompted individuals to explore natural solutions, thereby enhancing the appeal of manuka honey as a therapeutic agent. As a result, manufacturers are likely to expand their offerings to cater to this growing consumer base, further propelling the market forward.

Rising Interest in Functional Foods

The growing interest in functional foods is a notable driver for the manuka honey market in Europe. Consumers are increasingly seeking foods that offer health benefits beyond basic nutrition, and manuka honey fits this criterion perfectly. Its unique properties, such as anti-inflammatory and antioxidant effects, make it an attractive option for health-conscious individuals. Market Research Future indicates that the functional food sector in Europe is expected to reach €250 billion by 2026, with manuka honey playing a significant role in this growth. As consumers become more educated about the health benefits of manuka honey, its incorporation into various food products, such as smoothies and health bars, is likely to increase. This trend not only broadens the market appeal but also encourages innovation among manufacturers, further stimulating the manuka honey market.

Increased Awareness of Quality Standards

The manuka honey market in Europe is significantly influenced by the heightened awareness of quality standards among consumers. With the proliferation of counterfeit products, consumers are becoming more discerning about the authenticity and quality of manuka honey. The Unique Manuka Factor (UMF) rating system has emerged as a critical benchmark for quality, ensuring that consumers can identify genuine products. This awareness is driving demand for certified manuka honey, which is often priced higher due to its verified quality. Recent statistics indicate that sales of UMF-certified manuka honey have increased by over 30% in the past year alone. Consequently, this trend is likely to encourage producers to adhere to stringent quality control measures, thereby enhancing the overall reputation and reliability of the manuka honey market in Europe.

Influence of Social Media and Influencers

The influence of social media and health influencers is a significant driver for the manuka honey market in Europe. Platforms such as Instagram and TikTok have become vital channels for promoting health products, with influencers showcasing the benefits of manuka honey to their followers. This trend has led to a surge in consumer interest, as individuals are more likely to trust recommendations from influencers they follow. Recent surveys indicate that nearly 60% of consumers are influenced by social media when making health-related purchases. Consequently, brands are increasingly collaborating with influencers to enhance their visibility and credibility in the market. This dynamic is likely to propel the manuka honey market forward, as social media continues to shape consumer perceptions and purchasing decisions.