Expansion of Retail Channels

The manuka honey market benefits from the expansion of retail channels, which enhances product accessibility for consumers. In North America, traditional retail outlets, health food stores, and online platforms are increasingly stocking manuka honey products. The rise of e-commerce has particularly transformed the shopping experience, allowing consumers to easily compare products and prices. According to recent data, online sales of health products, including manuka honey, have surged by over 30% in the past year. This expansion of retail channels not only increases visibility but also caters to the diverse preferences of consumers, thereby driving growth in the manuka honey market. As more retailers recognize the demand for premium honey products, the market is likely to see further expansion.

Rising Interest in Functional Foods

The manuka honey market is significantly influenced by the rising interest in functional foods, which are perceived to offer health benefits beyond basic nutrition. In North America, consumers are increasingly incorporating functional foods into their diets, with the functional food market expected to grow at a CAGR of 8% through 2027. Manuka honey, known for its unique antibacterial properties and potential health benefits, fits seamlessly into this trend. As consumers become more health-conscious, they are likely to seek out foods that not only satisfy hunger but also contribute to overall well-being. This growing awareness and demand for functional foods are expected to drive the manuka honey market, as it is recognized for its potential to enhance health and wellness.

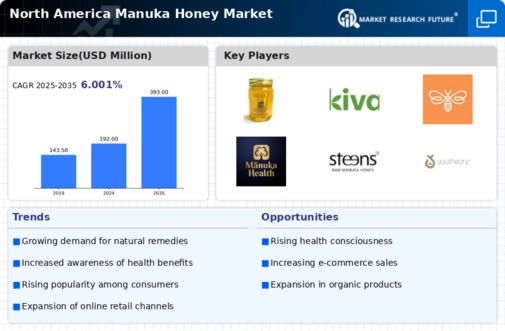

Increasing Demand for Natural Remedies

The manuka honey market experiences a notable surge in demand for natural remedies, driven by consumers' growing preference for holistic health solutions. This trend is particularly pronounced in North America, where individuals increasingly seek alternatives to synthetic products. The market for natural health products is projected to reach approximately $200 billion by 2025, with manuka honey positioned as a premium offering due to its unique properties. The antibacterial and anti-inflammatory benefits attributed to manuka honey further enhance its appeal, as consumers become more informed about the advantages of natural ingredients. This shift towards natural remedies is likely to bolster the manuka honey market, as it aligns with the broader movement towards wellness and preventive healthcare.

Influence of Social Media and Health Trends

The manuka honey market is notably influenced by social media and emerging health trends, which play a crucial role in shaping consumer perceptions and preferences. Platforms such as Instagram and TikTok have become vital for promoting health products, including manuka honey, as influencers share their experiences and recommendations. This digital word-of-mouth marketing has the potential to reach millions, creating a buzz around the product. In North America, the impact of social media on consumer behavior is profound, with studies indicating that over 70% of consumers are influenced by social media when making purchasing decisions. As health trends evolve and gain traction online, the manuka honey market is likely to benefit from increased visibility and consumer interest.

Growing Awareness of Antimicrobial Properties

The manuka honey market is significantly impacted by the growing awareness of the antimicrobial properties associated with manuka honey. Research indicates that manuka honey possesses unique compounds, such as methylglyoxal (MGO), which contribute to its antibacterial effects. As consumers become more educated about these properties, they are increasingly inclined to incorporate manuka honey into their health regimens. This trend is particularly relevant in North America, where the demand for natural antimicrobial agents is on the rise. The market for antimicrobial products is projected to grow substantially, and manuka honey is well-positioned to capitalize on this trend. The increasing recognition of its health benefits is likely to propel the manuka honey market forward.