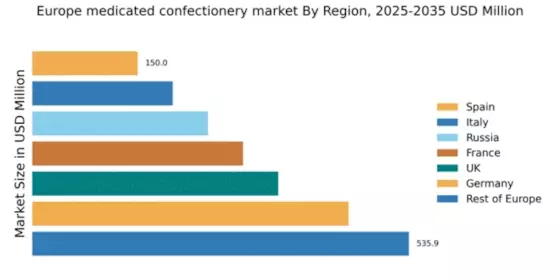

Germany : Strong Demand and Innovation Drive Growth

Key markets within Germany include major cities like Berlin, Munich, and Frankfurt, where consumer spending on health products is particularly high. The competitive landscape features significant players such as Bayer AG and Reckitt Benckiser, which have established strong brand loyalty. Local market dynamics are characterized by a growing trend towards natural ingredients and sugar-free options, catering to health-conscious consumers. The pharmaceutical sector also plays a crucial role in the medicated confectionery industry, with applications in cough and cold remedies.

UK : Consumer Awareness Fuels Market Expansion

Key markets include London, Manchester, and Birmingham, where urban populations are more inclined to purchase health-oriented products. The competitive landscape is dominated by major players like GlaxoSmithKline and Haleon, which leverage strong marketing strategies. Local dynamics reflect a growing preference for convenience and accessibility, with online sales channels gaining traction. The market is also influenced by seasonal trends, particularly during cold and flu seasons.

France : Cultural Factors Shape Consumption Trends

Key markets include Paris, Lyon, and Marseille, where consumer preferences for premium products are evident. The competitive landscape features significant players like Sanofi S.A. and Reckitt Benckiser, which cater to diverse consumer needs. Local market dynamics emphasize the importance of flavor and packaging, with a trend towards organic and natural ingredients. The market is also influenced by the pharmacy sector, which plays a vital role in product distribution.

Russia : Increasing Demand for Health Solutions

Key markets include Moscow and St. Petersburg, where urbanization drives demand for convenient health products. The competitive landscape features both local and international players, with companies like Pfizer Inc. and Bayer AG establishing a strong presence. Local dynamics reflect a shift towards online purchasing and increased availability of medicated confectionery in retail outlets. The market is also influenced by seasonal health trends, particularly during winter months.

Italy : Heritage Meets Health Innovation

Key markets include Rome, Milan, and Naples, where consumer preferences lean towards artisanal and high-quality products. The competitive landscape features major players like GlaxoSmithKline and local brands that emphasize heritage and authenticity. Local market dynamics highlight a growing interest in functional foods, with applications in cough and throat remedies gaining popularity. The pharmacy sector remains a crucial distribution channel for these products.

Spain : Increased Awareness Drives Sales

Key markets include Madrid and Barcelona, where urban populations are more inclined to purchase health-oriented products. The competitive landscape features significant players like Reckitt Benckiser and local brands that cater to specific health needs. Local dynamics reflect a growing preference for natural ingredients and sugar-free options, aligning with consumer health trends. The market is also influenced by seasonal demand, particularly during allergy seasons.

Rest of Europe : Regional Differences Shape Consumption

Key markets include countries like the Netherlands, Belgium, and the Nordic region, where consumer preferences vary widely. The competitive landscape features a mix of local and international players, with companies like Church & Dwight and MediCandy making significant inroads. Local market dynamics emphasize the importance of flavor and packaging, with a trend towards organic and natural ingredients. The market is also influenced by the pharmacy sector, which plays a vital role in product distribution.