Aging Population

The demographic shift towards an aging population in South Korea is likely to significantly influence the medicated confectionery market. As the population ages, there is an increasing prevalence of chronic health conditions, leading to a higher demand for products that can provide therapeutic benefits. Medicated confectionery items, which can offer relief from common ailments such as coughs and sore throats, are becoming more appealing to older consumers. This demographic is expected to drive a substantial portion of the market, with estimates suggesting that the elderly population will account for over 20% of the total population by 2030. Consequently, the medicated confectionery market may see a surge in demand as brands tailor their products to meet the specific needs of this demographic.

E-commerce Growth

The expansion of e-commerce platforms in South Korea is transforming the way consumers access medicated confectionery products. Online shopping offers convenience and a wider selection of products, which is particularly appealing to health-conscious consumers. The medicated confectionery market is benefiting from this trend, as more consumers turn to online retailers for their health-related purchases. Recent statistics indicate that e-commerce sales in the food and beverage sector have increased by over 30% in the past year. This shift towards online shopping presents an opportunity for brands to enhance their visibility and reach a broader audience, potentially driving growth in the medicated confectionery market.

Increasing Health Awareness

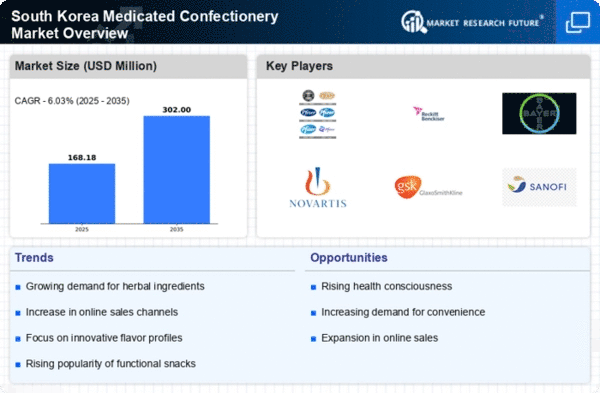

The growing awareness of health and wellness among consumers in South Korea appears to be a significant driver for the medicated confectionery market. As individuals become more conscious of their dietary choices, they are increasingly seeking products that offer health benefits. This trend is reflected in the rising demand for medicated confectionery items that provide functional advantages, such as immunity support and stress relief. According to recent data, the market for health-oriented snacks, including medicated confectionery, is projected to grow at a CAGR of approximately 8% over the next five years. This shift in consumer behavior indicates a potential for brands to innovate and expand their offerings in the medicated confectionery market, catering to the health-conscious demographic.

Convenience and On-the-Go Consumption

The fast-paced lifestyle of South Korean consumers is contributing to the growth of the medicated confectionery market. With an increasing number of individuals seeking convenient and portable health solutions, medicated confectionery products are well-positioned to meet this demand. The rise of on-the-go consumption patterns suggests that consumers prefer products that can be easily integrated into their daily routines. This trend is supported by market data indicating that snack foods, including medicated options, have seen a sales increase of approximately 15% in recent years. As a result, manufacturers in the medicated confectionery market are likely to focus on developing products that are not only effective but also convenient for consumers, thereby enhancing their market presence.

Regulatory Support for Health Products

The South Korean government's supportive regulatory framework for health-related products is likely to bolster the medicated confectionery market. Recent initiatives aimed at promoting health and wellness have led to the introduction of favorable policies for manufacturers of functional foods. This regulatory environment encourages innovation and the development of new medicated confectionery products that meet health standards. As a result, companies are more inclined to invest in research and development, leading to a diverse range of offerings in the medicated confectionery market. The potential for government support may enhance consumer trust and drive sales, as products are perceived to be safe and beneficial.