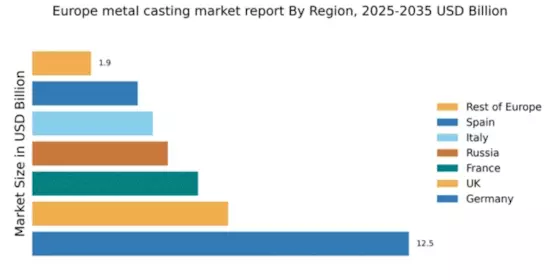

Germany : Strong industrial base and innovation

Key markets include Bavaria, North Rhine-Westphalia, and Baden-Württemberg, where major players like Thyssenkrupp and KSM Castings operate. The competitive landscape is characterized by a mix of established firms and innovative startups, fostering a dynamic business environment. Local demand is primarily driven by automotive, machinery, and construction sectors, with a focus on high-quality castings for precision applications. The emphasis on R&D and collaboration with universities enhances the region's competitive edge.

UK : Diverse applications and innovation

Key markets include West Midlands and Yorkshire, where companies like Alcoa and General Electric have a significant presence. The competitive landscape features a mix of traditional foundries and modern facilities adopting cutting-edge technologies. Local dynamics are influenced by a skilled workforce and strong supply chains, particularly in automotive and defense industries. The focus on lightweight materials and energy efficiency drives demand for advanced casting solutions.

France : Innovation and sustainability focus

Key markets include Île-de-France and Auvergne-Rhône-Alpes, where major players like BASF and Hitachi Metals operate. The competitive landscape is characterized by a blend of established firms and innovative startups, enhancing the business environment. Local demand is primarily driven by automotive, aerospace, and energy sectors, with a focus on high-performance castings. Collaboration between industry and research institutions supports technological advancements and market growth.

Russia : Resource-rich and expanding market

Key markets include Moscow and St. Petersburg, where major players are expanding operations. The competitive landscape features a mix of state-owned enterprises and private firms, creating a diverse business environment. Local dynamics are influenced by the demand for heavy machinery and automotive parts, with a focus on high-quality castings. The emphasis on local sourcing and production supports the growth of the domestic metal casting industry.

Italy : Heritage and innovation blend

Key markets include Lombardy and Emilia-Romagna, where companies like KSM Castings and Magna International are prominent. The competitive landscape is characterized by a mix of traditional foundries and modern facilities adopting innovative practices. Local demand is primarily driven by automotive, aerospace, and industrial applications, with a focus on high-quality castings. The rich heritage of craftsmanship combined with modern technology enhances Italy's competitive position in the market.

Spain : Innovation and sustainability drive growth

Key markets include Catalonia and Andalusia, where major players like Thyssenkrupp and local foundries operate. The competitive landscape features a mix of established firms and innovative startups, fostering a dynamic business environment. Local demand is primarily driven by automotive, energy, and construction sectors, with a focus on high-performance castings. The emphasis on R&D and collaboration with universities enhances the region's competitive edge.

Rest of Europe : Diverse landscape and potential growth

Key markets include smaller countries like Belgium and the Netherlands, where local foundries and manufacturers operate. The competitive landscape is characterized by a mix of small to medium-sized enterprises, fostering innovation and flexibility. Local dynamics are influenced by the demand for specialized castings and high-quality products. The focus on sustainability and efficiency drives growth in these niche markets, creating unique opportunities for local players.