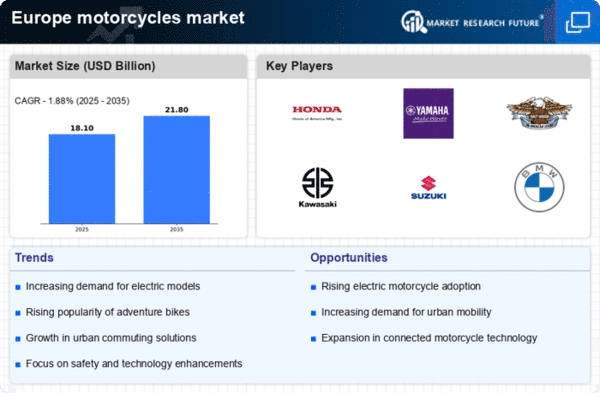

Urbanization and Traffic Congestion

As urban areas in Europe continue to expand, traffic congestion has become a pressing issue. This urbanization trend is influencing the motorcycles market, as motorcycles offer a practical solution for navigating crowded city streets. The compact size and maneuverability of motorcycles make them an attractive alternative to cars, particularly in densely populated areas. In 2025, it is estimated that motorcycle sales in urban regions have increased by 15% compared to previous years. The motorcycles market is likely to capitalize on this trend by promoting motorcycles as a convenient and efficient mode of transportation, potentially leading to further growth in urban markets.

Rising Disposable Income Among Consumers

The motorcycles market in Europe is benefiting from an increase in disposable income among consumers. As economic conditions improve, more individuals are willing to invest in leisure activities, including motorcycle ownership. In 2025, it is estimated that the average disposable income in Europe has risen by 5%, leading to a corresponding increase in motorcycle sales. This trend suggests that consumers are viewing motorcycles not only as a mode of transportation but also as a lifestyle choice. The motorcycles market is likely to respond by offering a wider range of models and price points to cater to this growing demographic of potential buyers.

Technological Innovations in Motorcycles

The motorcycles market in Europe is experiencing a wave of technological innovations that are enhancing the riding experience. Features such as advanced connectivity, smart navigation systems, and improved fuel efficiency are becoming increasingly prevalent. In 2025, it is projected that motorcycles equipped with smart technology will represent around 20% of total sales. These innovations not only attract tech-savvy consumers but also improve safety and performance, which are critical factors for many buyers. As manufacturers continue to invest in cutting-edge technology, the motorcycles market is likely to see sustained growth driven by consumer interest in high-tech features.

Growing Demand for Sustainable Transportation

The increasing awareness of environmental issues is driving the motorcycles market in Europe towards more sustainable transportation options. Consumers are becoming more conscious of their carbon footprint, leading to a surge in demand for eco-friendly motorcycles. This shift is reflected in the rising sales of electric motorcycles, which accounted for approximately 10% of total motorcycle sales in Europe in 2025. The motorcycles market is adapting to this trend by investing in research and development of greener technologies, which may further enhance market growth. Additionally, government incentives for electric vehicle purchases are likely to bolster this demand, making sustainable options more accessible to consumers.

Shift Towards Adventure and Touring Motorcycles

There is a noticeable shift in consumer preferences towards adventure and touring motorcycles within the motorcycles market in Europe. This trend is driven by a growing interest in outdoor activities and long-distance travel. In 2025, sales of adventure and touring motorcycles are projected to increase by 12%, reflecting a desire for versatile and capable machines. The motorcycles market is responding by expanding its offerings in this segment, providing consumers with more options that cater to their adventurous spirit. This shift not only enhances market diversity but also indicates a potential for increased profitability as manufacturers tap into this expanding niche.