Germany : Strong Growth and Innovation Landscape

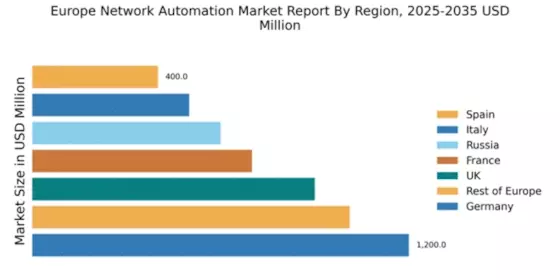

Germany holds a dominant position in the European network automation market, with a market value of $1200.0 million, representing approximately 30% of the total market share. Key growth drivers include robust industrial automation, significant investments in digital infrastructure, and a strong push towards Industry 4.0. Government initiatives, such as the Digital Strategy 2025, aim to enhance connectivity and promote innovation, further fueling demand for network automation solutions.

UK : Innovation and Investment Driving Growth

The UK network automation market is valued at $900.0 million, accounting for about 22.5% of the European market. Growth is driven by increasing cloud adoption, the rise of IoT applications, and a focus on cybersecurity. The UK government has introduced various initiatives to support digital infrastructure, including the National Digital Strategy, which aims to enhance connectivity across urban and rural areas, thereby boosting demand for automation solutions.

France : Strong Regulatory Support and Growth

France's network automation market is valued at $700.0 million, representing 17.5% of the European market. Key growth drivers include the government's commitment to digital transformation and significant investments in smart city initiatives. The French government has implemented policies to promote innovation in technology, which has led to increased demand for network automation solutions across various sectors, including telecommunications and transportation.

Russia : Regulatory Landscape and Growth Potential

Russia's network automation market is valued at $600.0 million, making up 15% of the European market. Growth is driven by the increasing need for efficient network management and the expansion of telecommunications infrastructure. However, regulatory challenges and geopolitical factors can impact market dynamics. The Russian government has initiated several programs to enhance digital infrastructure, which is expected to drive demand for automation solutions in the coming years.

Italy : Focus on Innovation and Connectivity

Italy's network automation market is valued at $500.0 million, representing 12.5% of the European market. Key growth drivers include the rise of digital services, increased investment in telecommunications, and a focus on smart manufacturing. The Italian government has launched initiatives to support digital transformation, which is expected to enhance the demand for network automation solutions across various industries, including automotive and manufacturing.

Spain : Investment in Digital Infrastructure

Spain's network automation market is valued at $400.0 million, accounting for 10% of the European market. Growth is driven by increasing investments in digital infrastructure and the adoption of cloud services. The Spanish government has implemented various initiatives to promote digitalization, including the Spain Digital 2025 agenda, which aims to enhance connectivity and support innovation, thereby boosting demand for network automation solutions.

Rest of Europe : Regional Variations and Opportunities

The Rest of Europe network automation market is valued at $1011.5 million, representing 25% of the total market. This sub-region includes a mix of developed and emerging markets, each with unique growth drivers. Factors such as varying regulatory environments, infrastructure development, and local demand trends influence market dynamics. Countries like the Netherlands and Sweden are leading in innovation, while Eastern European nations are rapidly adopting automation technologies.