Emergence of 5G Technology

The advent of 5G technology is poised to have a transformative impact on the network telemetry market in Europe. With its promise of ultra-fast data speeds and low latency, 5G is expected to enable a new era of connectivity, fostering the proliferation of smart devices and applications. This technological advancement necessitates sophisticated telemetry solutions capable of managing the complexities associated with 5G networks. Industry analysts project that the 5G market in Europe will exceed €100 billion by 2025, creating substantial opportunities for network telemetry providers. The integration of telemetry tools that can effectively monitor and analyze 5G network performance will be crucial for ensuring optimal service delivery and user experience. Thus, the emergence of 5G technology serves as a significant driver for innovation and growth in the network telemetry market.

Expansion of Cloud-Based Solutions

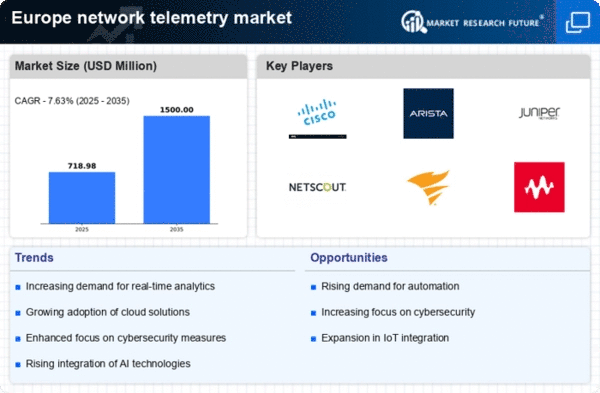

the network telemetry market in Europe is experiencing a significant shift towards cloud-based solutions.. This transition is largely attributed to the increasing adoption of cloud computing technologies by enterprises seeking scalable and flexible network management options. Cloud-based telemetry solutions offer enhanced accessibility, allowing organizations to monitor and analyze network performance from virtually anywhere. Recent data suggests that the cloud services market in Europe is expected to reach €200 billion by 2026, reflecting a robust growth trajectory. This expansion is likely to drive the demand for network telemetry solutions that can seamlessly integrate with cloud infrastructures, enabling businesses to leverage advanced analytics and improve their overall network visibility. Consequently, the proliferation of cloud-based services is poised to reshape the landscape of the network telemetry market.

Growing Demand for Real-Time Data Analysis

the network telemetry market in Europe is experiencing a notable surge in demand for real-time data analysis.. Organizations increasingly recognize the necessity of immediate insights to enhance operational efficiency and decision-making processes. This trend is driven by the proliferation of IoT devices and the need for continuous monitoring of network performance. According to recent estimates, the market for real-time analytics is projected to grow at a CAGR of approximately 25% over the next five years. This growth indicates a strong inclination towards solutions that provide instantaneous data processing capabilities, thereby fostering a more responsive and agile network environment. As businesses strive to optimize their operations, the integration of real-time data analysis tools within the network telemetry market becomes essential for maintaining competitive advantage.

Increased Investment in Network Infrastructure

the network telemetry market in Europe is experiencing heightened investment in network infrastructure.. As organizations strive to enhance their digital capabilities, there is a concerted effort to upgrade existing network systems and implement new technologies. This trend is particularly evident in sectors such as telecommunications, finance, and healthcare, where robust network performance is essential. Recent reports indicate that infrastructure spending in Europe is projected to reach €300 billion by 2027, reflecting a strong commitment to improving network reliability and efficiency. This influx of capital is likely to drive the adoption of advanced telemetry solutions that provide critical insights into network operations. Consequently, the increased investment in network infrastructure is a pivotal factor propelling the growth of the network telemetry market.

Rising Importance of Network Performance Optimization

In the context of the network telemetry market in Europe, the emphasis on network performance optimization is becoming increasingly pronounced. Organizations are compelled to ensure that their networks operate at peak efficiency to support the growing demands of digital transformation initiatives. This focus on optimization is reflected in the increasing investments in telemetry solutions that provide comprehensive insights into network health and performance metrics. Recent surveys indicate that approximately 70% of European enterprises prioritize network performance as a critical factor in their IT strategy. This trend underscores the necessity for advanced telemetry tools that can facilitate proactive monitoring and troubleshooting, ultimately leading to improved service delivery and user satisfaction. As such, the drive for network performance optimization is a key catalyst for growth within the network telemetry market.