Increased Cloud Adoption

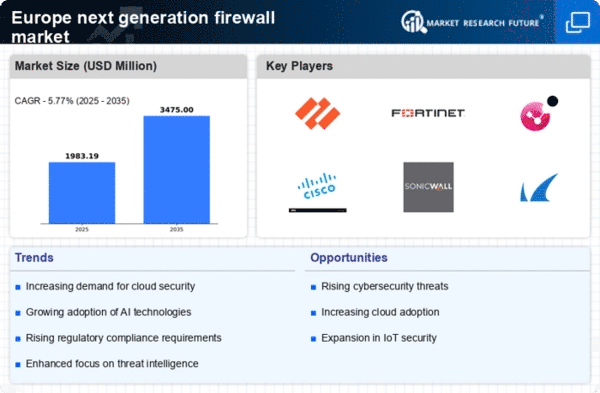

The rapid adoption of cloud services in Europe is a significant driver for the next generation-firewall market. As businesses migrate their operations to the cloud, they face new security challenges that require advanced protective measures. In 2025, it is estimated that over 70% of European enterprises will utilize cloud-based solutions, necessitating the implementation of next generation-firewall technologies to safeguard cloud environments. These firewalls offer features such as application awareness, user identity management, and threat intelligence, which are essential for securing cloud infrastructures. The growing reliance on cloud services is likely to fuel the demand for next generation-firewall solutions, as organizations seek to ensure the security of their data and applications in an increasingly digital landscape. This trend underscores the importance of integrating robust security measures into cloud strategies.

Shift Towards Remote Work

The transition to remote work arrangements across Europe has significantly impacted the next generation-firewall market. As organizations embrace flexible work models, the need for secure remote access to corporate networks has become paramount. In 2025, it is projected that over 30% of the European workforce will be working remotely, creating new vulnerabilities that traditional security measures may not adequately address. Next generation-firewall solutions are designed to provide secure access, ensuring that remote employees can connect to corporate resources without compromising security. This shift is prompting businesses to invest in advanced firewall technologies that can seamlessly integrate with virtual private networks (VPNs) and cloud services. As remote work continues to be a prevalent trend, the demand for next generation-firewall solutions is expected to rise, as organizations seek to protect their networks from potential threats associated with remote access.

Rising Cybersecurity Threats

The escalating frequency and sophistication of cyber threats in Europe is a primary driver for the next generation-firewall market. Organizations are increasingly targeted by advanced persistent threats (APTs), ransomware, and phishing attacks, necessitating robust security measures. In 2025, it is estimated that cybercrime will cost European businesses over €200 billion annually, highlighting the urgent need for enhanced security solutions. As a result, enterprises are investing heavily in next generation-firewall technologies to protect sensitive data and maintain operational integrity. This trend is likely to continue as the threat landscape evolves, pushing organizations to adopt more advanced security frameworks that can adapt to new challenges. Consequently, the demand for next generation-firewall solutions is expected to grow significantly, as businesses seek to fortify their defenses against an ever-changing array of cyber threats.

Regulatory Compliance Pressures

The increasing complexity of regulatory requirements across Europe is driving the demand for next generation-firewall solutions. Organizations must comply with various data protection regulations, such as the General Data Protection Regulation (GDPR) and the Network and Information Systems (NIS) Directive. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. As businesses strive to meet these stringent regulations, they are turning to next generation-firewall technologies that offer advanced features such as data loss prevention, intrusion detection, and real-time monitoring. This compliance-driven approach not only enhances security but also builds customer trust, making it a crucial factor in the growth of the next generation-firewall market. The ongoing evolution of regulatory frameworks is likely to further propel the adoption of these solutions in the coming years.

Technological Advancements in Security

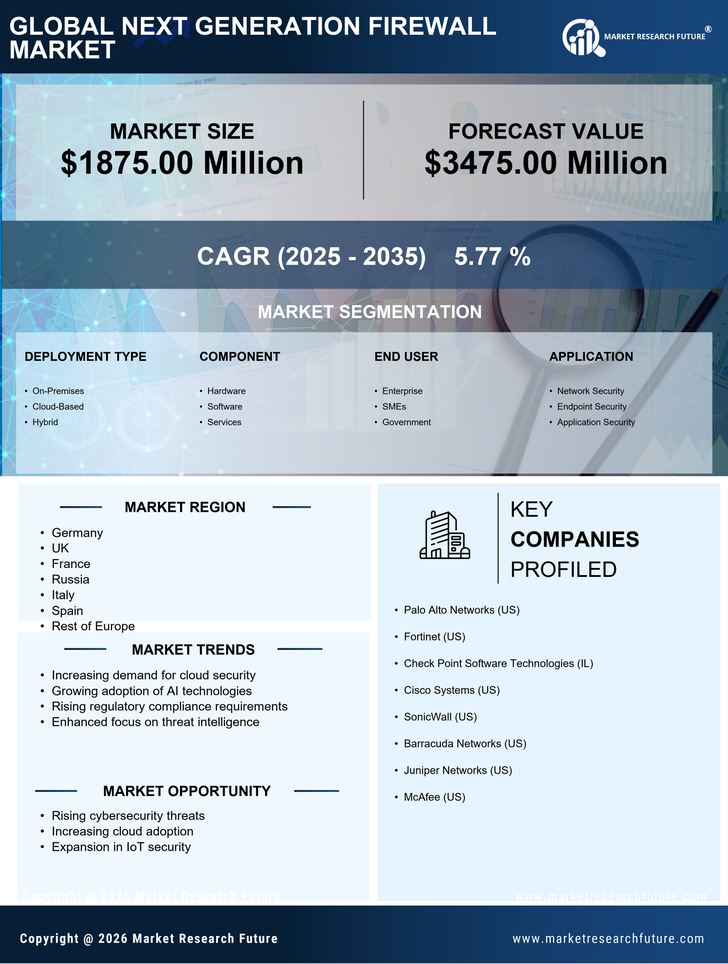

The continuous evolution of technology is a driving force behind the growth of the next generation-firewall market. Innovations in artificial intelligence, machine learning, and automation are enhancing the capabilities of firewalls, enabling them to detect and respond to threats more effectively. In 2025, it is anticipated that the market for next generation-firewall solutions will witness a compound annual growth rate (CAGR) of over 15%, driven by these technological advancements. Organizations are increasingly seeking firewalls that can provide real-time threat analysis, automated responses, and seamless integration with other security tools. This demand for advanced features is likely to propel the adoption of next generation-firewall solutions, as businesses aim to stay ahead of emerging threats and maintain a robust security posture. The integration of cutting-edge technologies into firewall solutions is expected to shape the future of cybersecurity in Europe.