Rising Cyber Threats

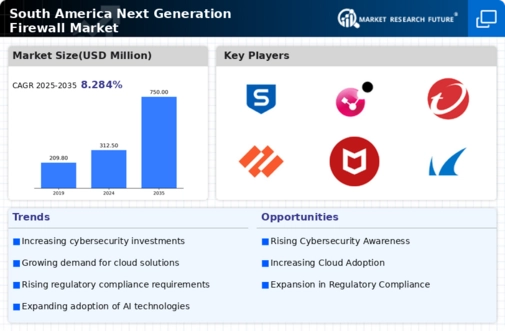

The escalating frequency and sophistication of cyber threats in South America is a primary driver for the next generation-firewall market. Organizations are increasingly targeted by cybercriminals, leading to a heightened demand for advanced security solutions. In 2025, it is estimated that cybercrime costs in the region could reach $150 billion, prompting businesses to invest in robust firewall technologies. The next generation-firewall market is responding to this urgency by offering solutions that provide real-time threat intelligence and automated responses. As companies seek to protect sensitive data and maintain operational integrity, the adoption of next generation-firewalls is likely to surge, reflecting a proactive approach to cybersecurity.

Emergence of IoT Devices

The proliferation of Internet of Things (IoT) devices in South America is significantly impacting the next generation-firewall market. As more devices connect to networks, the potential attack surface for cyber threats expands, necessitating advanced security solutions. The next generation-firewall market is evolving to address these challenges by providing specialized security features tailored for IoT environments. In 2025, it is estimated that the number of connected IoT devices in the region will exceed 1 billion, highlighting the urgency for effective security measures. This growth presents a substantial opportunity for the next generation-firewall market, as organizations seek to protect their networks from the vulnerabilities associated with IoT connectivity.

Growing Remote Work Culture

The shift towards remote work in South America has created new security challenges, thereby driving the next generation-firewall market. As more employees work from home, organizations face increased risks of data breaches and cyberattacks. The next generation-firewall market is responding by offering solutions that secure remote access and protect sensitive information. In 2025, it is anticipated that remote work will account for 30% of the workforce in the region, underscoring the need for robust security measures. This trend is likely to accelerate the adoption of next generation-firewalls, as businesses prioritize the protection of their digital assets in a distributed work environment.

Increased Regulatory Requirements

The tightening of regulatory frameworks in South America is driving the next generation-firewall market. Governments are implementing stricter data protection laws, compelling organizations to enhance their cybersecurity measures. For instance, the introduction of the General Data Protection Regulation (GDPR) equivalent in various South American countries mandates that businesses adopt comprehensive security solutions. This regulatory pressure is expected to propel the next generation-firewall market, as companies seek to comply with legal requirements while safeguarding customer data. The financial implications of non-compliance can be severe, further incentivizing organizations to invest in advanced firewall technologies.

Digital Transformation Initiatives

The ongoing digital transformation across various sectors in South America is significantly influencing the next generation-firewall market. As businesses migrate to digital platforms and adopt cloud-based services, the need for enhanced security measures becomes paramount. In 2025, it is projected that the digital economy in South America will account for over 20% of the region's GDP, necessitating advanced security frameworks. The next generation-firewall market is adapting to these changes by providing solutions that integrate seamlessly with digital infrastructures. This alignment not only enhances security but also supports business agility, making it a critical driver for firewall adoption in the region.