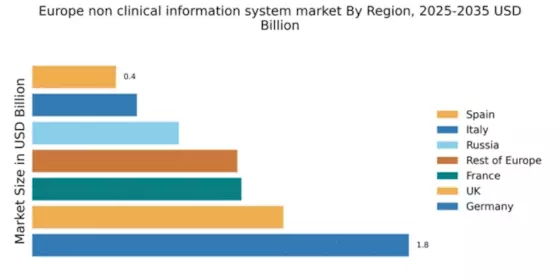

Germany : Strong Growth and Innovation Hub

Germany holds a dominant market share of 1.8 in the non-clinical information systems sector, driven by robust healthcare infrastructure and increasing digitalization. Key growth drivers include government initiatives promoting eHealth, rising demand for integrated healthcare solutions, and a focus on patient-centered care. Regulatory policies support innovation, while investments in technology enhance operational efficiency across healthcare facilities.

UK : Innovation and Regulation in Healthcare

The UK market, valued at 1.2, is characterized by a strong emphasis on regulatory compliance and innovation. Growth is fueled by the National Health Service's (NHS) digital strategy, which aims to improve patient outcomes through technology. Demand for non-clinical systems is rising, particularly in telehealth and data analytics, as healthcare providers seek to enhance service delivery and operational efficiency.

France : Focus on Integration and Efficiency

France's non-clinical information systems market, valued at 1.0, is experiencing significant growth driven by government initiatives like the 'Ma Santé 2022' plan. This plan emphasizes digital health integration and aims to streamline healthcare services. The demand for innovative solutions is increasing, particularly in urban areas, as healthcare providers adapt to evolving patient needs and regulatory frameworks.

Russia : Regulatory Changes and Opportunities

Russia's market, valued at 0.7, is gradually expanding as the government pushes for modernization in healthcare. Key growth drivers include regulatory reforms aimed at improving healthcare delivery and increasing investments in technology. Demand for non-clinical systems is rising, particularly in major cities like Moscow and St. Petersburg, where healthcare facilities are adopting digital solutions to enhance efficiency and patient care.

Italy : Focus on Patient-Centric Solutions

Italy's non-clinical information systems market, valued at 0.5, is steadily growing, driven by a focus on patient-centric healthcare solutions. Government initiatives aimed at digital transformation are fostering demand for innovative technologies. Key cities like Milan and Rome are leading the charge, with healthcare providers increasingly adopting non-clinical systems to improve operational efficiency and patient engagement.

Spain : Investment in Digital Health Solutions

Spain's market, valued at 0.4, is emerging as a significant player in the non-clinical information systems sector. Growth is driven by increased investment in digital health solutions and a focus on improving healthcare delivery. Regulatory support and initiatives aimed at enhancing telemedicine and data management are shaping demand, particularly in urban centers like Madrid and Barcelona.

Rest of Europe : Opportunities Across Multiple Regions

The Rest of Europe, with a market value of 0.98, encompasses a diverse range of healthcare systems and regulatory environments. Growth is driven by varying levels of digital adoption and government initiatives across countries. Key markets include the Nordic countries and Eastern Europe, where investments in healthcare technology are increasing. Local dynamics vary significantly, influencing demand for non-clinical systems in different regions.