Increased Focus on Safety Standards

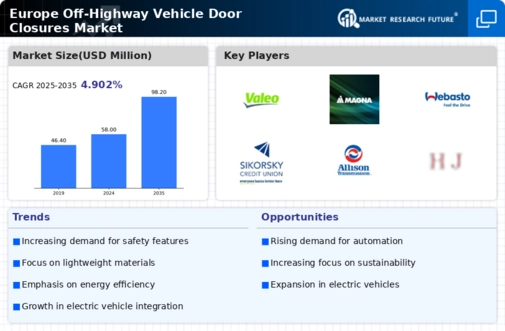

The in Europe is being propelled by an increased focus on safety standards across various industries. Regulatory bodies are implementing stringent safety regulations that necessitate the use of high-quality door closures in off highway vehicles. In 2025, it is anticipated that compliance with these safety standards will become a critical factor for manufacturers, influencing approximately 40% of purchasing decisions. This heightened emphasis on safety is prompting manufacturers to innovate and enhance the durability and reliability of door closures. Consequently, the off highway-vehicle-door-closures market is expected to expand as companies prioritize safety in their vehicle designs, ensuring that they meet or exceed regulatory requirements.

Growth of Agricultural Machinery Sector

The agricultural machinery sector is witnessing substantial growth, which is positively impacting the in Europe. As farmers increasingly adopt advanced machinery to enhance productivity, the demand for reliable door closures in agricultural vehicles is on the rise. In 2025, the agricultural machinery market in Europe is projected to reach €25 billion, with a compound annual growth rate of around 4%. This growth is likely to drive the need for durable and efficient door closure systems that can withstand the rigors of agricultural operations. Manufacturers are responding to this trend by developing specialized door closures tailored to the unique requirements of agricultural vehicles, thereby fostering growth in the off highway-vehicle-door-closures market.

Rising Demand for Construction Equipment

The in Europe is experiencing a notable surge in demand, primarily driven by the construction sector. As infrastructure projects expand, the need for robust and reliable door closures in construction vehicles becomes paramount. In 2025, the construction equipment market in Europe is projected to reach approximately €40 billion, indicating a growth rate of around 5% annually. This growth directly correlates with the increasing requirement for durable door closures that can withstand harsh working conditions. Furthermore, manufacturers are focusing on enhancing the quality and functionality of door closures to meet the evolving needs of construction equipment operators. This trend suggests that the off highway-vehicle-door-closures market will continue to thrive as construction activities intensify across various European nations.

Sustainability Initiatives in Manufacturing

Sustainability initiatives are becoming increasingly important in the manufacturing processes of the in Europe. As environmental concerns rise, manufacturers are adopting eco-friendly materials and production methods to reduce their carbon footprint. In 2025, it is estimated that around 25% of door closures will be produced using sustainable materials, reflecting a significant shift towards greener practices. This trend not only aligns with consumer preferences for environmentally responsible products but also positions manufacturers favorably in a competitive market. The off highway-vehicle-door-closures market is likely to benefit from this focus on sustainability, as companies strive to meet the growing demand for eco-friendly solutions in vehicle manufacturing.

Technological Innovations in Vehicle Design

Technological advancements in vehicle design are significantly influencing the in Europe. The integration of smart technologies, such as automated locking systems and enhanced safety features, is becoming increasingly prevalent. In 2025, it is estimated that around 30% of new off highway vehicles will incorporate advanced door closure technologies. This shift not only improves user convenience but also enhances vehicle security and operational efficiency. Manufacturers are investing in research and development to create innovative door closure solutions that align with modern vehicle designs. As a result, the off highway-vehicle-door-closures market is likely to witness a transformation, driven by the demand for cutting-edge technology in vehicle manufacturing.