Growth of Agricultural Machinery

The off highway-vehicle-door-closures market is positively impacted by the growth of agricultural machinery in the US. With the increasing adoption of advanced farming techniques and machinery, there is a rising need for durable and efficient door closure systems in agricultural vehicles. The agricultural sector is projected to expand at a CAGR of around 4.5%, driven by technological advancements and the need for improved productivity. This growth translates into a higher demand for off highway-vehicle-door-closures, as manufacturers seek to provide solutions that enhance the functionality and safety of agricultural equipment. The emphasis on reliability and ease of use in agricultural machinery further propels the market, as operators require door closures that can withstand harsh working conditions. Consequently, the growth of agricultural machinery is likely to remain a significant driver for the off highway-vehicle-door-closures market.

Increased Focus on Customization

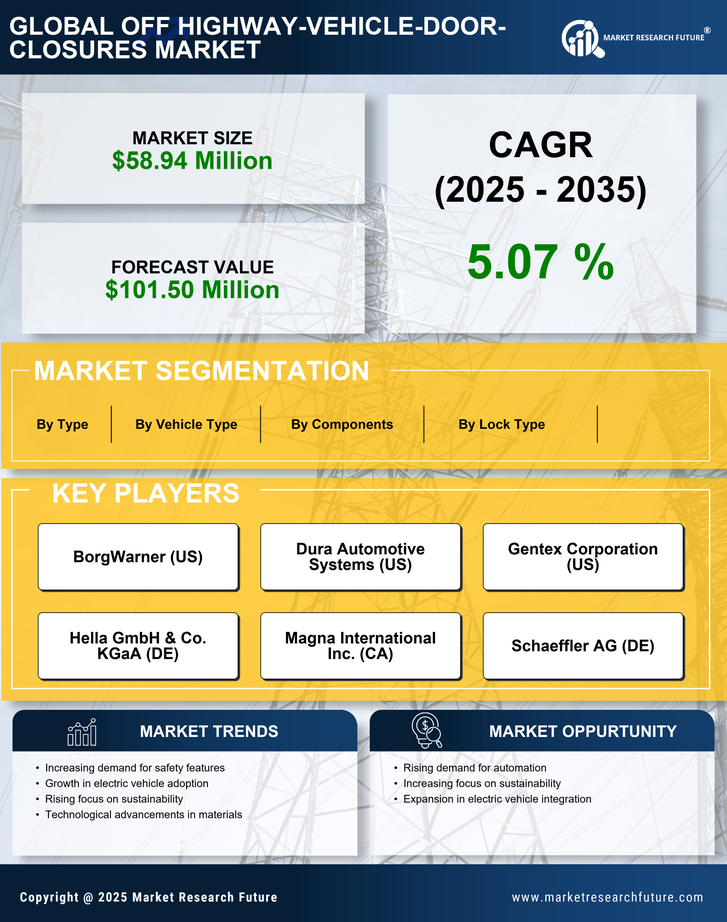

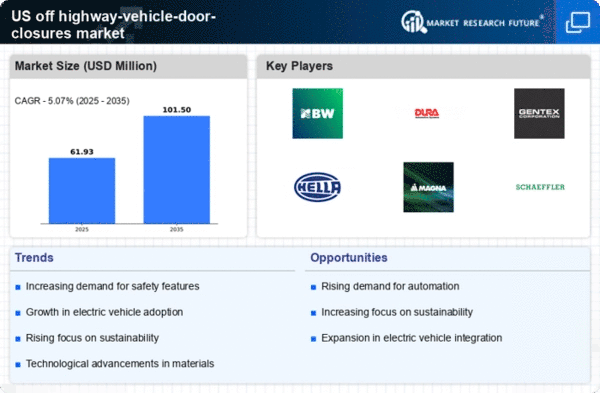

Customization is emerging as a vital driver in the off highway-vehicle-door-closures market, as manufacturers respond to the diverse needs of end-users. The demand for tailored solutions that cater to specific vehicle types and applications is on the rise. This trend is particularly evident in sectors such as construction and agriculture, where vehicles often require unique door closure systems to enhance functionality. The market is anticipated to grow by approximately 5% as manufacturers invest in research and development to create customized products. This focus on customization not only meets the specific requirements of operators but also fosters innovation within the off highway-vehicle-door-closures market. As companies strive to differentiate their offerings, the ability to provide bespoke solutions is likely to become a key competitive advantage.

Rising Demand for Construction Equipment

The off highway-vehicle-door-closures market experiences a notable surge in demand driven by the expanding construction sector in the US. As infrastructure projects gain momentum, the need for robust and reliable door closures in construction vehicles becomes paramount. The construction industry is projected to grow at a CAGR of approximately 5.5% over the next few years, which directly influences the off highway-vehicle-door-closures market. This growth is attributed to increased investments in public infrastructure and residential projects, necessitating durable and efficient door closure systems. Consequently, manufacturers are focusing on developing innovative solutions that cater to the specific requirements of construction vehicles, thereby enhancing their market presence. The rising demand for construction equipment is likely to propel the off highway-vehicle-door-closures market, as companies seek to improve vehicle functionality and safety through advanced door closure technologies.

Regulatory Compliance and Safety Standards

The off highway-vehicle-door-closures market is significantly influenced by stringent regulatory compliance and safety standards imposed by government agencies in the US. These regulations mandate that vehicle manufacturers adhere to specific safety protocols, which include the implementation of reliable door closure systems. As safety becomes a priority, manufacturers are compelled to invest in advanced technologies that ensure compliance with these standards. The increasing focus on worker safety in off highway applications, such as mining and agriculture, further drives the demand for high-quality door closures. The market is expected to witness a growth rate of around 4% annually as companies strive to meet these regulatory requirements. This trend not only enhances the safety of operators but also boosts the overall market for off highway-vehicle-door-closures, as manufacturers innovate to create compliant and efficient products.

Technological Integration in Vehicle Design

Advanced technologies integrated into vehicle design are key drivers for the off highway-vehicle-door-closures market. As manufacturers adopt smart technologies, such as IoT and automation, the demand for sophisticated door closure systems increases. These technologies enhance vehicle performance and user experience, leading to a projected market growth of approximately 6% over the next few years. The incorporation of electronic locking mechanisms and remote access features in door closures aligns with the evolving needs of operators in off highway applications. This trend indicates a shift towards more intelligent and user-friendly vehicle designs, which could potentially reshape the off highway-vehicle-door-closures market. As manufacturers continue to innovate, the focus on integrating technology into door closure systems is likely to remain a driving force in the industry.