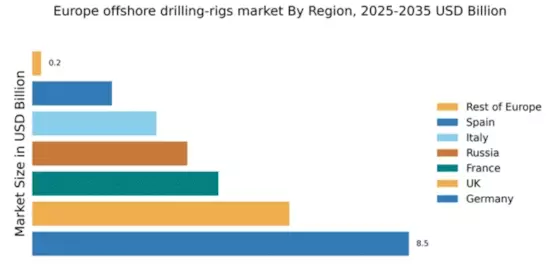

Germany : Strong Infrastructure and Investment

Germany holds a significant market share of 8.5% in the offshore drilling sector, driven by robust industrial infrastructure and a commitment to renewable energy integration. Key growth drivers include government initiatives promoting energy independence and investments in advanced drilling technologies. The demand for offshore drilling is bolstered by the country's focus on natural gas exploration and stringent regulatory policies aimed at environmental sustainability. Infrastructure development, particularly in the North Sea, supports this growth trajectory.

UK : Innovation and Regulatory Support

The UK offshore drilling market accounts for 5.8% of the European share, with London and Aberdeen as key hubs. Growth is fueled by a combination of technological advancements and favorable regulatory frameworks that encourage investment in exploration and production. The demand for oil and gas remains strong, particularly in the North Sea, where aging fields are being revitalized through innovative drilling techniques. Government policies supporting carbon capture and storage further enhance market potential.

France : Focus on Sustainability and Growth

France's offshore drilling market represents 4.2% of the European total, with significant activity in the Mediterranean Sea. The growth is driven by a shift towards sustainable energy practices and government incentives for offshore wind projects. Demand trends indicate a rising interest in hybrid energy solutions, combining oil and gas with renewables. Regulatory policies are increasingly focused on environmental protection, influencing operational practices in the sector.

Russia : Resource-Rich and Geopolitically Influenced

Russia holds a 3.5% share in the offshore drilling market, primarily driven by its vast natural resources in the Arctic and Caspian regions. Key growth drivers include state-backed investments and a focus on energy security. The demand for offshore drilling is supported by the country's need to maintain its position as a leading energy exporter. Regulatory frameworks are often influenced by geopolitical factors, impacting foreign investments and partnerships.

Italy : Investment in Energy Diversification

Italy's offshore drilling market accounts for 2.8% of the European share, with significant operations in the Adriatic Sea. The growth is driven by investments in energy diversification and exploration of untapped reserves. Demand trends indicate a shift towards natural gas, supported by government initiatives aimed at reducing carbon emissions. Regulatory policies are evolving to facilitate exploration while ensuring environmental protection, creating a balanced approach to energy development.

Spain : Focus on Renewable Integration

Spain's offshore drilling market represents 1.8% of the European total, with a growing emphasis on integrating renewable energy sources. The market is driven by government policies promoting offshore wind and gas exploration. Demand trends reflect a shift towards sustainable energy solutions, with regulatory frameworks supporting innovation in drilling technologies. Key regions include the Canary Islands and the Mediterranean coast, where exploration activities are increasing.

Rest of Europe : Limited Activity but Potential Growth

The Rest of Europe accounts for a mere 0.2% of the offshore drilling market, with limited activity primarily in smaller nations. However, there is potential for growth as countries explore their offshore resources. Key drivers include regional collaborations and EU policies promoting energy independence. Demand trends are influenced by local energy needs and environmental considerations, with regulatory frameworks gradually evolving to support exploration.