Geopolitical Factors

Geopolitical factors are a significant driver of the offshore drilling-rigs market in North America. The region's strategic position in global energy markets makes it susceptible to fluctuations in international relations and trade policies. Tensions in oil-producing regions can lead to supply chain disruptions, prompting North American companies to enhance their offshore drilling capabilities to ensure energy security. Additionally, the U.S. government's policies regarding energy independence and foreign relations can impact investment decisions in the offshore sector. As North America seeks to bolster its energy production, the offshore drilling-rigs market may experience increased activity as companies respond to geopolitical uncertainties. This dynamic environment necessitates adaptability and strategic planning among industry players to navigate the complexities of the global energy landscape.

Rising Energy Demand

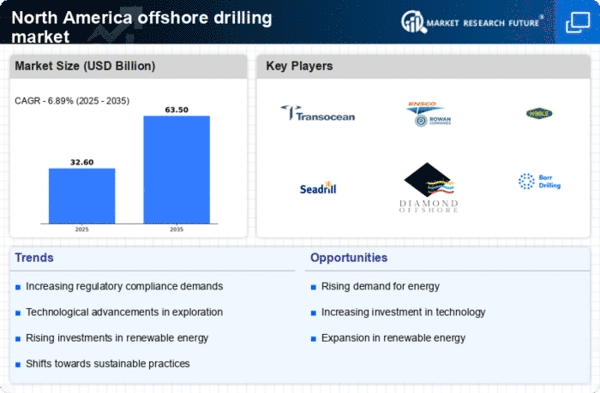

The increasing energy demand in North America is a primary driver for the offshore drilling-rigs market. As populations grow and economies expand, the need for energy sources, particularly oil and natural gas, intensifies. The U.S. Energy Information Administration (EIA) projects that energy consumption will rise by approximately 10% by 2030. This surge in demand necessitates the exploration and extraction of hydrocarbons from offshore reserves, thereby propelling investments in drilling technologies and infrastructure. Consequently, the offshore drilling-rigs market is likely to experience significant growth as companies seek to capitalize on these opportunities. Furthermore, the shift towards cleaner energy sources may also lead to increased offshore wind energy projects, diversifying the market landscape and creating additional demand for specialized drilling rigs.

Environmental Regulations

Environmental regulations significantly influence the offshore drilling-rigs market in North America. Stricter regulations aimed at minimizing environmental impact and ensuring safety have become increasingly prevalent. The Bureau of Ocean Energy Management (BOEM) has implemented comprehensive guidelines that require operators to adhere to stringent environmental standards. Compliance with these regulations often necessitates the adoption of advanced technologies and practices, which can lead to increased operational costs. However, these regulations also create opportunities for innovation within the offshore drilling-rigs market, as companies invest in cleaner and more efficient drilling methods. The potential for regulatory changes may drive operators to seek out modern rigs that meet or exceed these standards, thereby fostering a competitive market environment.

Technological Innovations

Technological innovations play a pivotal role in shaping the offshore drilling-rigs market. The advent of advanced drilling techniques, such as horizontal drilling and hydraulic fracturing, has revolutionized the extraction process, allowing for more efficient and cost-effective operations. The integration of automation and digital technologies, including real-time data analytics and remote monitoring, enhances operational efficiency and safety. As companies adopt these innovations, they can optimize drilling performance and reduce operational costs. The offshore drilling-rigs market is likely to see a surge in demand for rigs equipped with cutting-edge technologies, as operators seek to maximize production while minimizing environmental impact. Furthermore, the ongoing research and development efforts in this field suggest that the pace of technological advancement will continue to accelerate, further driving market growth.

Investment in Infrastructure

Investment in infrastructure is a crucial driver for the offshore drilling-rigs market in North America. The region has witnessed substantial capital inflows aimed at enhancing drilling capabilities and expanding operational efficiency. According to the American Petroleum Institute, investments in offshore infrastructure are projected to exceed $100 billion over the next decade. This influx of capital is expected to facilitate the development of advanced drilling technologies, improve safety measures, and enhance environmental compliance. As companies modernize their fleets and upgrade existing rigs, the offshore drilling-rigs market stands to benefit from increased operational capacity and reduced downtime. Moreover, the establishment of new supply chains and logistics networks will further support the growth of this sector, ensuring that drilling operations can meet the rising energy demands effectively.