Rising Demand for Energy Security

The oil well-cement market in Europe experiences a notable surge in demand driven by the increasing focus on energy security. As geopolitical tensions and fluctuating energy prices persist, countries are prioritizing domestic energy production. This trend necessitates the drilling of new oil wells, thereby amplifying the need for high-quality cement to ensure well integrity. In 2025, the European oil production is projected to reach approximately 1.5 million barrels per day, indicating a robust market for oil well-cement. The industry must adapt to this growing demand by enhancing production capabilities and ensuring the availability of specialized cement products that meet the rigorous standards required for oil extraction.

Growing Focus on Sustainable Practices

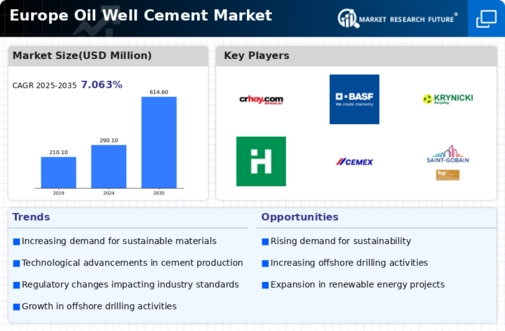

The growing focus on sustainable practices within the oil and gas sector is influencing the oil well-cement market in Europe. Companies are increasingly adopting sustainable methods to reduce their carbon footprint and enhance operational efficiency. This shift is likely to drive demand for eco-friendly cement alternatives, which are designed to minimize environmental impact. By 2025, it is expected that the market for sustainable cement solutions could grow by 20%, reflecting a broader trend towards sustainability in the energy sector. The oil well-cement market must align its product offerings with these sustainable practices to capture emerging opportunities.

Investment in Oil Exploration Projects

Investment in oil exploration projects significantly influences the oil well-cement market in Europe. With the European Union aiming to reduce dependency on external energy sources, there is a renewed interest in exploring untapped reserves. In 2025, it is estimated that investment in exploration could exceed €10 billion, leading to an increase in drilling activities. This influx of capital is likely to create a favorable environment for the oil well-cement market, as new wells require substantial amounts of cement for construction and maintenance. The industry must prepare for this potential growth by ensuring that supply chains are robust and capable of meeting the anticipated demand.

Environmental Regulations and Compliance

Environmental regulations and compliance play a crucial role in shaping the oil well-cement market in Europe. Stricter regulations aimed at minimizing the environmental impact of oil extraction are being implemented across various countries. These regulations often require the use of specialized cement that meets specific environmental standards. As of 2025, it is anticipated that compliance costs could rise by 15%, compelling companies to invest in higher-quality cement solutions. The oil well-cement market must navigate these regulatory landscapes effectively to ensure that products not only meet performance criteria but also adhere to environmental guidelines.

Technological Innovations in Cement Production

Technological innovations in cement production are poised to reshape the oil well-cement market in Europe. Advances in materials science and engineering are leading to the development of more efficient and durable cement formulations. These innovations not only enhance the performance of cement in extreme conditions but also reduce the environmental impact of cement production. In 2025, it is projected that the adoption of these technologies could improve cement performance by up to 30%, thereby increasing the reliability of oil wells. The oil well-cement market must stay abreast of these developments to remain competitive and meet the evolving needs of oil producers.