Rising Awareness of Soil Health

There is a growing recognition of the importance of soil health within the organic fertilizers market in Europe. Farmers and agricultural stakeholders are increasingly aware that healthy soil is fundamental to sustainable agriculture and food security. The use of organic fertilizers contributes to soil fertility, enhances microbial activity, and improves water retention. Recent studies indicate that organic fertilizers can increase soil organic matter by up to 30%, which is crucial for maintaining soil health. This awareness drives demand for organic fertilizers as farmers seek to improve crop yields while minimizing environmental impact. The emphasis on soil health aligns with broader sustainability goals, making organic fertilizers an attractive option for modern agricultural practices.

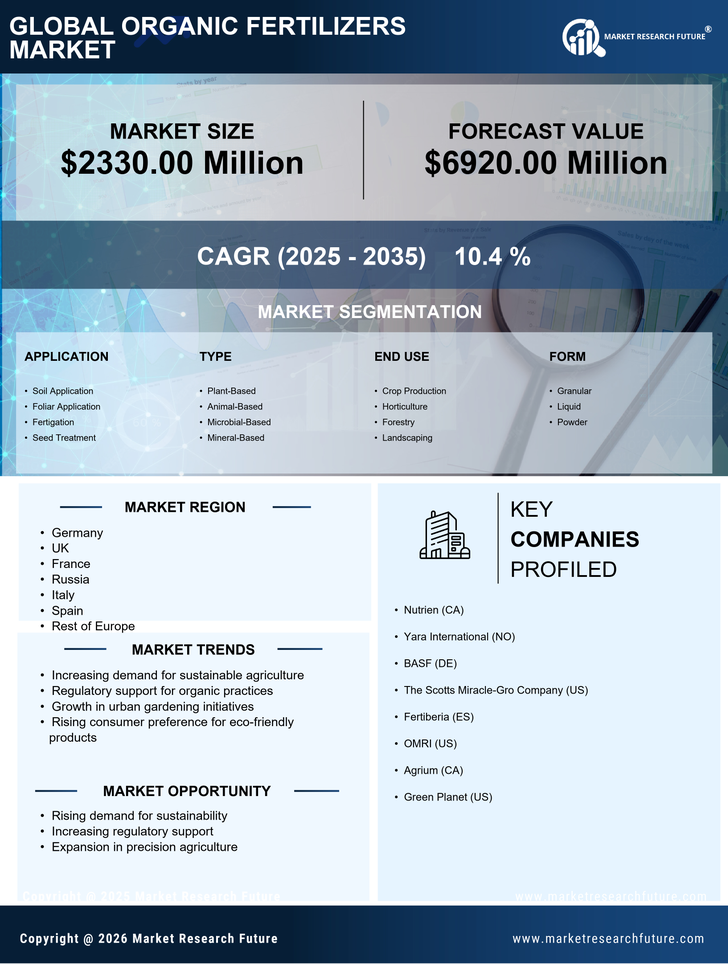

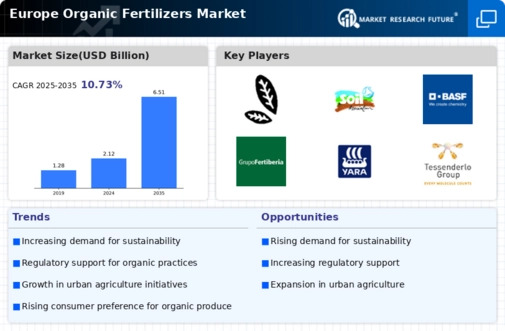

Regulatory Support for Organic Practices

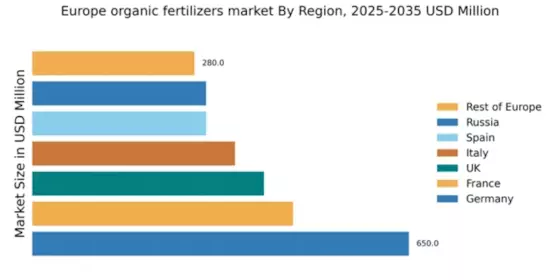

The organic fertilizers market in Europe benefits from robust regulatory frameworks that promote organic farming practices. The European Union has established regulations that encourage the use of organic fertilizers, aiming to reduce chemical inputs in agriculture. This regulatory support is reflected in the EU's Common Agricultural Policy, which allocates substantial funding for organic farming initiatives. As of 2025, approximately 8% of the total agricultural land in Europe is under organic farming, indicating a growing trend. The increasing number of certifications and standards for organic products further enhances consumer trust and market growth. This regulatory environment not only fosters the adoption of organic fertilizers but also positions the industry for sustainable growth, as farmers seek to comply with environmental standards and consumer preferences.

Increased Investment in Organic Agriculture

Investment in organic agriculture is a significant driver for the organic fertilizers market in Europe. As the demand for organic products continues to rise, both public and private sectors are channeling funds into organic farming initiatives. In 2025, investments in organic agriculture are projected to reach €1 billion, reflecting a commitment to sustainable farming practices. This influx of capital supports research and development in organic fertilizers, leading to improved product offerings and greater market penetration. Additionally, financial incentives for farmers transitioning to organic practices further stimulate the market. The increased investment not only enhances the availability of organic fertilizers but also strengthens the overall organic agriculture sector, creating a positive feedback loop that benefits all stakeholders.

Consumer Preference for Eco-Friendly Products

The organic fertilizers market in Europe is significantly influenced by consumer preferences for eco-friendly products. As consumers become more environmentally conscious, they increasingly seek products that align with their values. This trend is evident in the food sector, where organic produce sales have surged, with a reported increase of 12% in 2025 alone. Such consumer behavior extends to agricultural inputs, where farmers are motivated to adopt organic fertilizers to meet market demand. Retailers are also responding by expanding their offerings of organic products, further driving the market. This shift towards eco-friendly solutions not only supports the organic fertilizers market but also encourages sustainable agricultural practices across Europe.

Technological Advancements in Fertilizer Production

Technological innovations play a crucial role in shaping the organic fertilizers market in Europe. Advances in production techniques, such as the development of bio-based fertilizers and improved composting methods, enhance the efficiency and effectiveness of organic fertilizers. These innovations can lead to higher nutrient content and better soil compatibility, which are essential for modern agricultural practices. The market is witnessing a rise in the use of precision agriculture technologies, which allow for targeted application of organic fertilizers, optimizing their use and minimizing waste. As of 2025, it is estimated that the adoption of such technologies could increase the efficiency of organic fertilizers by up to 20%, thereby boosting their appeal among farmers and contributing to market growth.