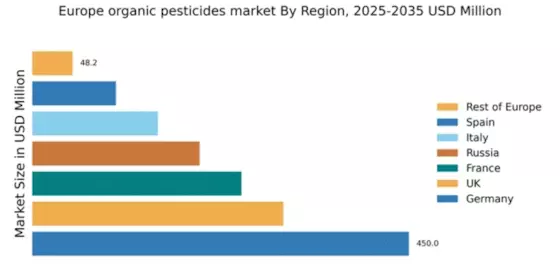

Germany : Strong Demand and Innovation Drive Growth

Germany holds a dominant position in the European organic pesticides market, accounting for 450.0 million USD, representing approximately 40% of the total market share. Key growth drivers include increasing consumer demand for organic produce, stringent EU regulations promoting sustainable agriculture, and government initiatives supporting organic farming. The country’s robust infrastructure and advanced research facilities further enhance its market potential, fostering innovation in organic pesticide formulations.

UK : Sustainability Trends Fueling Demand

Key markets include London, Yorkshire, and the Midlands, where organic farming is gaining traction. The competitive landscape features major players like Bayer AG and Syngenta AG, which are investing in local partnerships and innovations. The UK market is characterized by a growing number of small to medium-sized enterprises focusing on organic solutions, enhancing the business environment for sustainable agriculture.

France : Regulatory Support Boosts Market Growth

Key regions include Provence-Alpes-Côte d'Azur and Aquitaine, where organic farming is prevalent. The competitive landscape features significant players like BASF SE and FMC Corporation, which are actively involved in research and development. The local market dynamics are favorable, with a growing interest in organic farming practices across various sectors, including viticulture and horticulture.

Russia : Potential Growth Amidst Challenges

Key markets include Moscow and Krasnodar, where agricultural activities are concentrated. The competitive landscape is evolving, with local players beginning to emerge alongside international companies like Nufarm Limited. The business environment is gradually improving, with a focus on enhancing organic farming practices in various sectors, including grain and vegetable production.

Italy : Cultural Shift Towards Sustainability

Key regions include Tuscany and Emilia-Romagna, known for their agricultural heritage. The competitive landscape features major players like Bayer AG and local companies focusing on organic solutions. The market dynamics are favorable, with increasing investments in organic farming technologies and a growing consumer base interested in organic products across various sectors, including olive oil and wine production.

Spain : Rising Demand for Organic Products

Key markets include Andalusia and Catalonia, where organic farming is becoming more prevalent. The competitive landscape includes major players like Syngenta AG and local firms focusing on organic solutions. The business environment is improving, with a growing number of farmers transitioning to organic practices, particularly in the fruit and vegetable sectors.

Rest of Europe : Varied Growth Across Smaller Markets

Key markets include smaller countries like Belgium and the Netherlands, where organic farming is gaining popularity. The competitive landscape features a mix of local and international players, including AgroFresh Solutions Inc. and Organic Laboratories Inc. The business environment is diverse, with opportunities for growth in niche markets and specific agricultural sectors, such as horticulture and specialty crops.