Sustainability Initiatives by Farmers

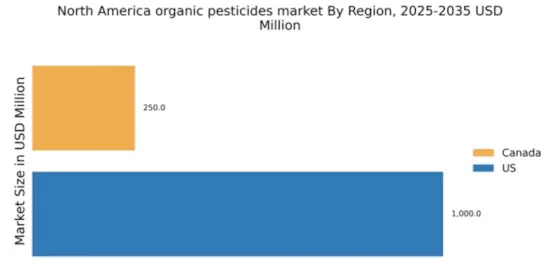

Sustainability has become a focal point for farmers in North America, influencing their choice of pest control methods. The organic pesticides market is witnessing a shift as farmers adopt sustainable practices to meet consumer demand for environmentally friendly products. Many farmers are transitioning to organic farming methods, which often require the use of organic pesticides. This shift is supported by various sustainability initiatives and programs that promote organic farming. In 2025, it is estimated that around 15% of farmland in North America is dedicated to organic farming, indicating a growing trend towards sustainable agriculture. This transition not only benefits the environment but also enhances the market for organic pesticides.

Regulatory Support for Organic Farming

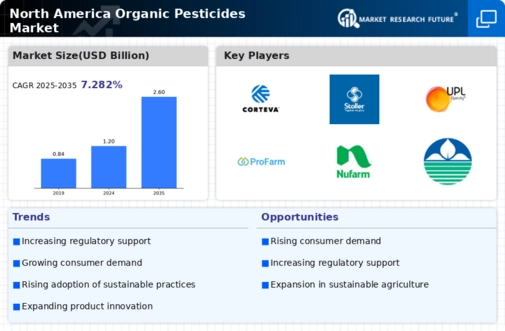

The organic pesticides market in North America is positively influenced by regulatory support aimed at promoting organic farming practices. Government agencies are implementing policies that encourage the use of organic pesticides, providing incentives for farmers to transition from conventional methods. In 2025, it is projected that funding for organic farming initiatives will exceed $200 million, reflecting the government's commitment to supporting sustainable agriculture. This regulatory environment fosters growth in the organic pesticides market, as farmers are more likely to adopt organic solutions when backed by favorable policies. The alignment of regulatory frameworks with market needs is likely to enhance the adoption of organic pesticides.

Increasing Awareness of Health Benefits

The organic pesticides market in North America is experiencing growth due to rising consumer awareness regarding health benefits associated with organic farming. As consumers become more informed about the potential health risks linked to synthetic pesticides, there is a noticeable shift towards organic alternatives. This trend is reflected in the increasing sales of organic produce, which reached approximately $50 billion in 2024. The organic pesticides market is likely to benefit from this heightened awareness, as consumers actively seek products that align with their health-conscious lifestyles. Furthermore, educational campaigns and initiatives by health organizations are contributing to this awareness, potentially driving demand for organic pesticides in the agricultural sector.

Consumer Preference for Eco-Friendly Products

The organic pesticides market in North America is significantly influenced by the growing consumer preference for eco-friendly products. As environmental concerns rise, consumers are increasingly opting for products that are perceived as safe for both health and the environment. This trend is evident in the organic food sector, where sales have surged, with organic fruits and vegetables accounting for over 10% of total produce sales in 2024. The organic pesticides market is likely to see a corresponding increase in demand as consumers seek out organic options for pest control. This shift in consumer behavior is expected to drive innovation and growth within the organic pesticides market.

Technological Advancements in Organic Pesticides

The organic pesticides market is benefiting from technological advancements that enhance the efficacy and application of organic pest control solutions. Innovations in formulation and delivery methods are making organic pesticides more effective, thereby increasing their appeal to farmers. For instance, the development of biopesticides derived from natural sources has shown promising results in pest management. In 2025, the market for biopesticides is expected to grow by approximately 12%, indicating a strong trend towards innovative organic solutions. These advancements not only improve pest control but also align with the growing demand for sustainable agricultural practices, further driving the organic pesticides market.