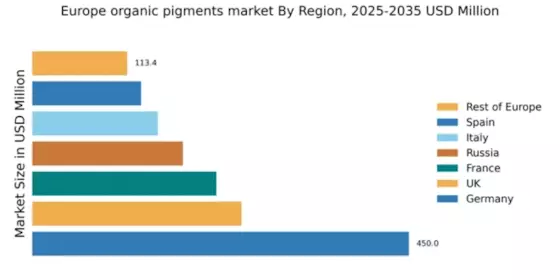

Germany : Strong industrial base drives growth

Key markets include North Rhine-Westphalia and Bavaria, where major industrial hubs are located. The competitive landscape features significant players like BASF SE and Lanxess AG, which have established strong market positions. Local dynamics are characterized by a focus on innovation and sustainability, with applications spanning coatings, plastics, and textiles. The business environment is favorable, supported by a skilled workforce and advanced research facilities.

UK : Innovation fuels market expansion

Key markets include London and Manchester, where demand for organic pigments in the printing and coatings industries is rising. The competitive landscape features players like Huntsman Corporation and Clariant AG, which are adapting to local market needs. The business environment is dynamic, with a focus on innovation and collaboration among industry stakeholders. Applications in packaging and automotive sectors are particularly prominent, driving further growth.

France : Strong focus on innovation and quality

Key markets include Paris and Lyon, where demand for high-quality pigments is significant. The competitive landscape includes major players like DIC Corporation and Kremer Pigments GmbH & Co. KG, which are well-established in the region. Local dynamics favor innovation, with a strong emphasis on quality and sustainability. The business environment is supportive, with various sectors actively seeking eco-friendly solutions, particularly in the fashion and automotive industries.

Russia : Industrial expansion drives demand

Key markets include Moscow and St. Petersburg, where industrial activities are concentrated. The competitive landscape features both local and international players, with companies like Sun Chemical Corporation establishing a presence. Local market dynamics are characterized by a growing demand for high-performance pigments, particularly in coatings and plastics. The business environment is improving, with increased investments in infrastructure and technology.

Italy : Quality and tradition drive market

Key markets include Milan and Florence, where the fashion and design industries drive demand for high-quality pigments. The competitive landscape features established players like Kremer Pigments GmbH & Co. KG and local manufacturers. The business environment is characterized by a strong emphasis on craftsmanship and innovation, particularly in the textile and art sectors. Local dynamics favor collaboration between industry and academia, fostering research and development.

Spain : Innovation and sustainability at forefront

Key markets include Barcelona and Madrid, where industrial activities are concentrated. The competitive landscape features both local and international players, with companies like Toyo Ink SC Holdings Co., Ltd. gaining traction. Local dynamics favor innovation, with a focus on sustainable practices across various sectors. The business environment is evolving, with increased investments in green technologies and infrastructure.

Rest of Europe : Varied applications across regions

Key markets include regions in Scandinavia and Eastern Europe, where demand for organic pigments is growing. The competitive landscape features a mix of local and international players, adapting to regional needs. Local dynamics are characterized by a focus on sustainability and innovation, with various sectors actively seeking eco-friendly solutions. The business environment is supportive, with increasing collaboration among industry stakeholders.