Increased Recycling Initiatives

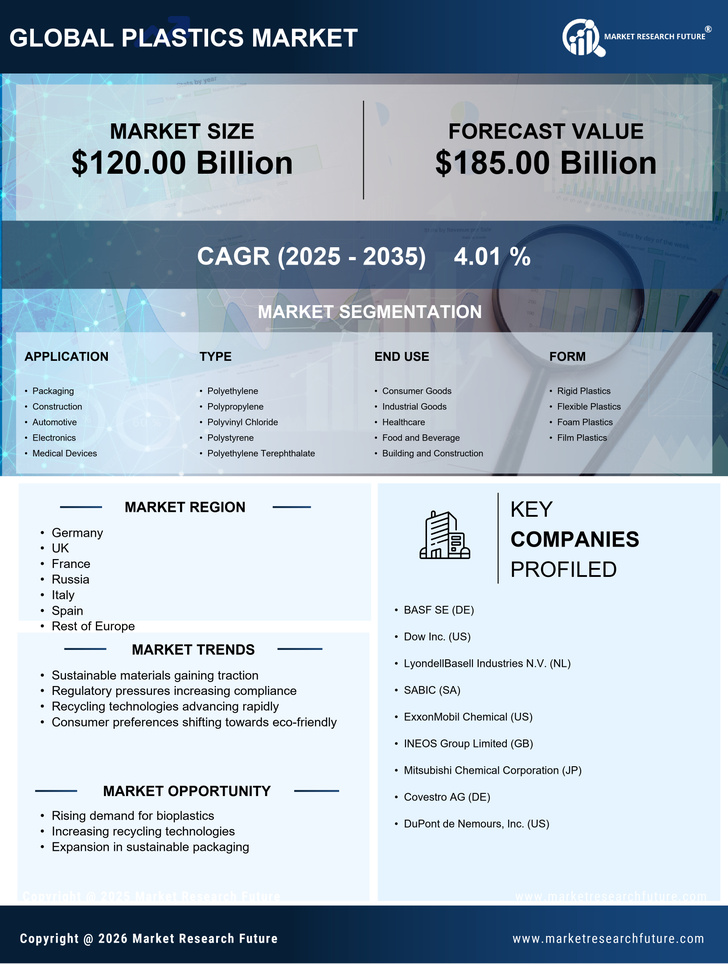

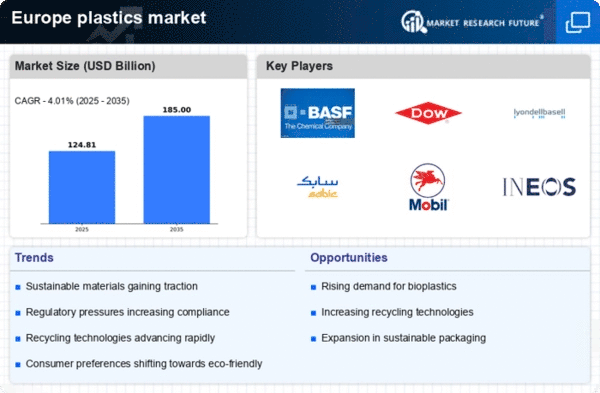

In Europe, the push for a circular economy is significantly influencing the plastics market. Governments and organizations are implementing robust recycling initiatives aimed at reducing plastic waste and promoting sustainability. The European Union has set ambitious targets, such as recycling 50% of plastic waste by 2025. This regulatory framework encourages the development of advanced recycling technologies and the use of recycled materials in production processes. As a result, companies are increasingly investing in recycling capabilities, which not only helps in compliance with regulations but also reduces raw material costs. The integration of recycled plastics into new products is expected to enhance the competitiveness of the plastics market, potentially leading to a market growth of around 5% over the next few years.

Expansion of End-Use Applications

The expansion of end-use applications is a significant driver for the plastics market in Europe. Industries such as construction, healthcare, and electronics are increasingly utilizing plastics due to their versatility and performance characteristics. For example, the construction sector is adopting plastic materials for insulation, piping, and roofing solutions, driven by the need for energy efficiency and durability. Additionally, the healthcare industry is leveraging plastics for medical devices and packaging, ensuring safety and hygiene. This diversification of applications is expected to fuel demand, with the plastics market projected to grow by approximately 5.5% over the next five years. As new applications emerge, the industry is likely to witness further innovation and development.

Rising Demand for Lightweight Materials

The plastics market in Europe is experiencing a notable increase in demand for lightweight materials, particularly in the automotive and aerospace sectors. This trend is driven by the need for improved fuel efficiency and reduced emissions. For instance, the European automotive industry aims to reduce CO2 emissions by 55% by 2030, which necessitates the use of lighter materials. Plastics, being versatile and lightweight, are increasingly favored over traditional materials like metals. This shift is expected to propel the plastics market, with projections indicating a growth rate of approximately 4.5% annually through 2027. As manufacturers seek to comply with stringent environmental regulations, the adoption of lightweight plastics is likely to become a critical driver in the industry.

Consumer Preference for Eco-Friendly Products

The plastics market in Europe is witnessing a shift in consumer preferences towards eco-friendly products. As awareness of environmental issues grows, consumers are increasingly seeking products made from sustainable materials. This trend is particularly evident in sectors such as packaging, where brands are responding by offering biodegradable and recyclable options. Market Research Future indicates that approximately 60% of European consumers are willing to pay a premium for sustainable packaging solutions. This consumer behavior is prompting manufacturers to innovate and adapt their product lines, thereby driving growth in the plastics market. Companies that prioritize sustainability are likely to gain a competitive edge, as they align with the values of environmentally conscious consumers.

Technological Advancements in Production Processes

Technological advancements are playing a pivotal role in shaping the plastics market in Europe. Innovations such as 3D printing, automation, and smart manufacturing are enhancing production efficiency and reducing costs. These technologies enable manufacturers to produce complex plastic components with precision and speed, catering to diverse industries including healthcare, automotive, and consumer goods. The integration of Industry 4.0 principles is expected to revolutionize production processes, leading to increased competitiveness in the market. As companies adopt these advanced technologies, the plastics market is projected to experience a growth rate of approximately 6% annually, driven by enhanced productivity and reduced time-to-market for new products.