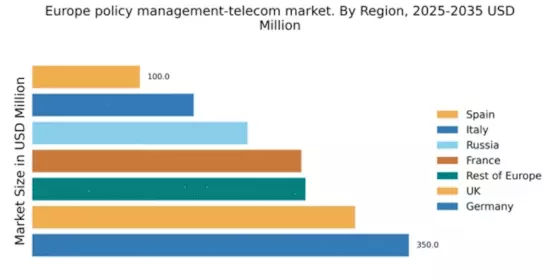

Germany : Strong Growth and Innovation Hub

Germany holds a commanding market share of 35% in the European telecom sector, valued at $350.0 million. Key growth drivers include robust demand for 5G technology, increasing digitalization, and government initiatives promoting smart city projects. Regulatory policies are supportive, with the Federal Network Agency ensuring fair competition and infrastructure development, which is crucial for enhancing service delivery and consumer satisfaction.

UK : Innovation and Competition Thrive

Key markets include London, Manchester, and Birmingham, where competition is fierce among major players like BT, Vodafone, and Virgin Media. The landscape is characterized by a mix of established firms and emerging startups, fostering innovation. The business environment is conducive, with a focus on enhancing customer experience and expanding service offerings in sectors like fintech and e-commerce.

France : Diverse Services and Strong Demand

Key markets include Paris, Lyon, and Marseille, where major players like Orange, SFR, and Bouygues Telecom dominate. The competitive landscape is marked by aggressive pricing strategies and service differentiation. The business environment is favorable, with a focus on digital transformation across various sectors, including healthcare and education, driving demand for advanced telecom solutions.

Russia : Growth Amidst Regulatory Challenges

Key markets include Moscow, St. Petersburg, and Kazan, where major players like MTS, Beeline, and MegaFon are prominent. The competitive landscape is evolving, with a focus on improving service quality and customer experience. Local market dynamics are influenced by economic conditions and consumer preferences, with a growing demand for mobile applications and digital services across various industries.

Italy : Focus on Digital Transformation

Key markets include Rome, Milan, and Naples, where major players like Telecom Italia and Vodafone Italy are active. The competitive landscape is characterized by a mix of established companies and new entrants, focusing on service differentiation and customer engagement. The business environment is supportive, with a growing emphasis on digital services in sectors like e-commerce and entertainment.

Spain : Investment in Infrastructure and Services

Key markets include Madrid, Barcelona, and Valencia, where major players like Telefónica and Vodafone Spain are prominent. The competitive landscape is dynamic, with a focus on improving service quality and customer satisfaction. Local market dynamics are influenced by consumer preferences and technological advancements, driving demand for innovative telecom solutions in various sectors.

Rest of Europe : Varied Markets with Unique Dynamics

Key markets include cities across Scandinavia, Eastern Europe, and the Balkans, where major players like Ericsson and Nokia have a significant presence. The competitive landscape varies, with established firms and local players vying for market share. Local market dynamics are influenced by economic conditions and consumer preferences, with a growing emphasis on digital services and connectivity.