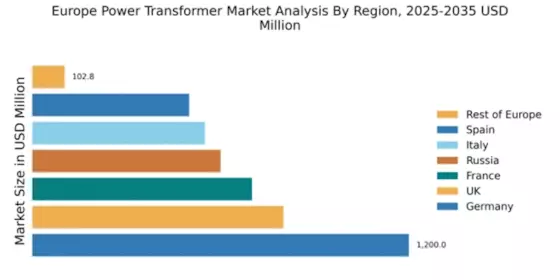

Germany : Strong Demand and Innovation Drive Growth

Germany holds a commanding market share of 40% in the European power transformer market, valued at $1,200.0 million. Key growth drivers include the transition to renewable energy sources, which has spurred demand for efficient transformers. Government initiatives, such as the Energiewende policy, promote sustainable energy infrastructure, while significant investments in industrial development enhance consumption patterns. Regulatory frameworks support innovation and modernization in the energy sector.

UK : Strong Infrastructure Fuels Transformer Demand

The UK power transformer market accounts for 26.7% of the European share, valued at $800.0 million. Growth is driven by infrastructure upgrades and the push for smart grid technologies. Demand trends indicate a shift towards high-efficiency transformers, supported by government policies aimed at reducing carbon emissions. The UK government’s Green Deal encourages investments in energy-efficient technologies, further boosting market potential.

France : Focus on Sustainability and Efficiency

France represents 23.3% of the European market, with a value of $700.0 million. The growth is propelled by the country's commitment to nuclear energy and renewable sources. Demand for transformers is increasing due to modernization efforts in the energy sector, supported by government initiatives like the Multiannual Energy Program. Regulatory policies emphasize energy efficiency, driving consumption patterns towards advanced transformer technologies.

Russia : Investment in Energy Infrastructure Growth

Russia holds a market share of 20% in Europe, valued at $600.0 million. Key growth drivers include significant investments in energy infrastructure and the modernization of existing facilities. Demand trends show a rising need for reliable power supply in urban areas. Government initiatives focus on enhancing energy security and efficiency, while regulatory frameworks support local manufacturing and innovation in the power sector.

Italy : Focus on Renewable Energy Integration

Italy accounts for 18.3% of the European market, valued at $550.0 million. The growth is driven by the integration of renewable energy sources and the need for grid modernization. Demand trends indicate a shift towards smart transformers that enhance energy efficiency. Government policies, such as the National Energy Strategy, promote investments in sustainable technologies, while regional initiatives support local manufacturing and innovation.

Spain : Investment in Green Energy Solutions

Spain represents 16.7% of the European market, valued at $500.0 million. The growth is fueled by investments in renewable energy projects and the modernization of the electrical grid. Demand trends show an increasing preference for high-efficiency transformers, supported by government initiatives like the Renewable Energy Plan. Regulatory policies encourage innovation and sustainability in the energy sector, enhancing market dynamics.

Rest of Europe : Diverse Needs Across Smaller Regions

The Rest of Europe accounts for a smaller market share of 2.5%, valued at $102.8 million. Growth is driven by localized energy needs and specific regulatory frameworks that support renewable energy initiatives. Demand trends vary significantly across countries, influenced by local policies and infrastructure development. Competitive dynamics include both local and international players, with a focus on tailored solutions for diverse applications.