Urbanization and Population Growth

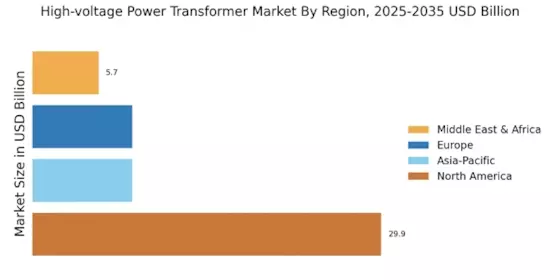

Urbanization and population growth are significant factors influencing the High-voltage Power Transformer Market. As urban areas expand, the demand for electricity surges, necessitating the installation of high-voltage transformers to support increased load requirements. The United Nations projects that by 2050, nearly 68% of the world’s population will reside in urban areas, leading to heightened energy consumption. This demographic shift is likely to drive investments in electrical infrastructure, including high-voltage power transformers, to ensure that urban centers can meet their energy needs. Consequently, the High-voltage Power Transformer Market is poised for growth as cities evolve and expand.

Regulatory Frameworks and Standards

Regulatory frameworks and standards play a pivotal role in shaping the High-voltage Power Transformer Market. Governments and regulatory bodies are increasingly implementing stringent efficiency and safety standards for electrical equipment, including high-voltage transformers. Compliance with these regulations often necessitates the adoption of newer, more efficient transformer technologies. For example, the implementation of international standards such as IEC 60076 has prompted manufacturers to innovate and enhance their product offerings. This regulatory environment not only ensures safety and reliability but also drives the demand for high-voltage transformers that meet these evolving standards. As such, the High-voltage Power Transformer Market is likely to experience growth in response to these regulatory pressures.

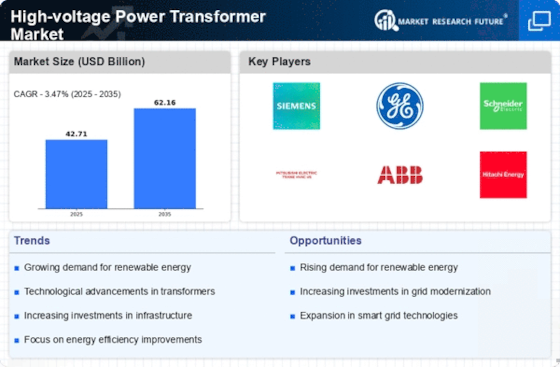

Increasing Demand for Renewable Energy

The transition towards renewable energy sources is driving the High-voltage Power Transformer Market. As countries strive to meet sustainability goals, the integration of renewable energy into existing grids necessitates the use of high-voltage transformers. These transformers are essential for efficiently transmitting electricity generated from wind, solar, and hydroelectric sources over long distances. According to recent data, the renewable energy sector is projected to grow at a compound annual growth rate of over 8% in the coming years, further propelling the demand for high-voltage power transformers. This trend indicates a significant shift in energy production and consumption patterns, which could reshape the landscape of the High-voltage Power Transformer Market.

Infrastructure Development Initiatives

Infrastructure development initiatives across various regions are contributing to the expansion of the High-voltage Power Transformer Market. Governments are investing heavily in modernizing and expanding electrical grids to accommodate growing energy demands. For instance, the construction of new power plants and the upgrade of existing facilities require robust high-voltage transformers to ensure reliable electricity distribution. Recent reports suggest that infrastructure spending in the energy sector is expected to reach trillions of dollars over the next decade, highlighting the potential for growth in the High-voltage Power Transformer Market. This investment trend underscores the critical role of high-voltage transformers in supporting energy infrastructure.

Technological Innovations in Transformer Design

Technological innovations in transformer design are reshaping the High-voltage Power Transformer Market. Advances in materials and engineering techniques have led to the development of more efficient and compact transformers. These innovations not only enhance performance but also reduce energy losses during transmission. For instance, the introduction of amorphous steel in transformer cores has shown to improve efficiency by up to 30%. As energy efficiency becomes a priority for utilities and industries, the demand for advanced high-voltage transformers is likely to increase. This trend suggests a dynamic evolution within the High-voltage Power Transformer Market, driven by the need for improved technology.