Increasing Demand for Renewable Energy

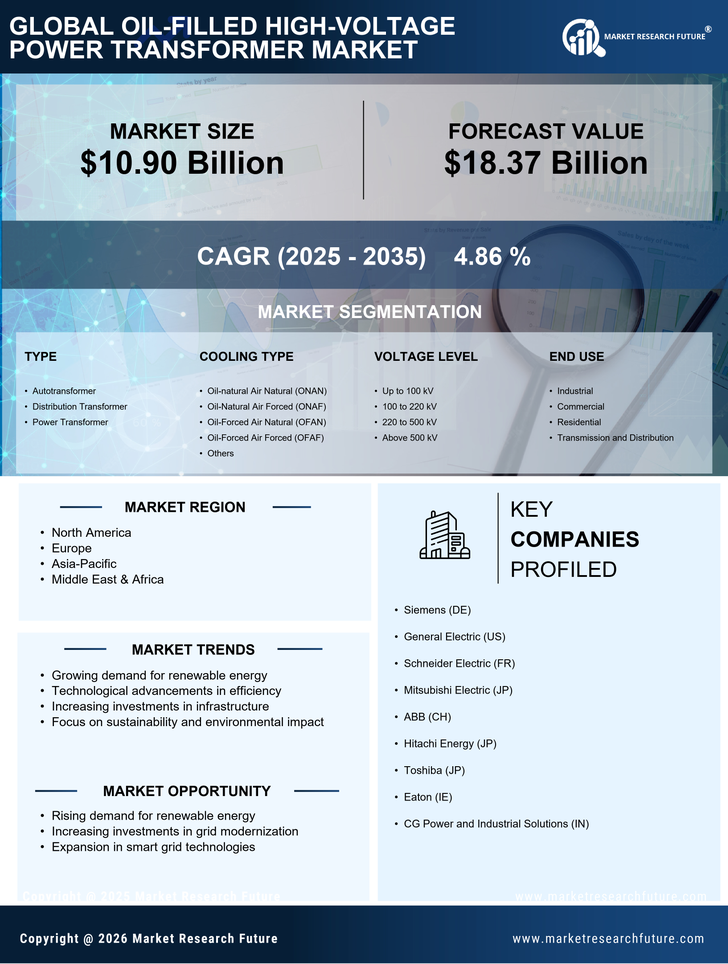

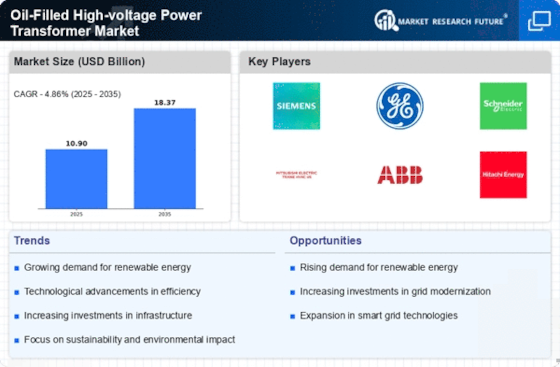

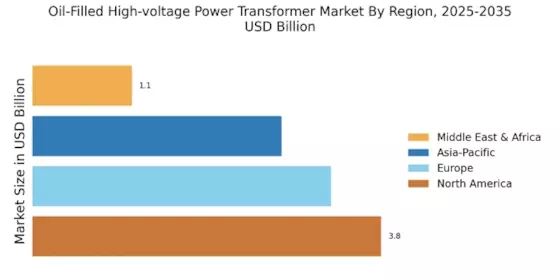

The transition towards renewable energy sources is driving the Oil-Filled High-voltage Power Transformer Market. As countries strive to meet their energy needs sustainably, the integration of renewable energy sources such as wind and solar power necessitates the use of high-voltage transformers. These transformers are essential for efficiently transmitting electricity generated from renewable sources to the grid. In 2025, the demand for renewable energy is projected to increase significantly, with investments in infrastructure upgrades and new installations. This trend indicates a robust growth trajectory for the Oil-Filled High-voltage Power Transformer Market, as utilities and energy providers seek reliable solutions to manage the complexities of renewable energy integration.

Regulatory Support for Energy Efficiency

Regulatory frameworks promoting energy efficiency are significantly impacting the Oil-Filled High-voltage Power Transformer Market. Governments worldwide are implementing stringent regulations aimed at reducing energy consumption and enhancing the efficiency of electrical systems. These regulations often mandate the use of high-efficiency transformers, which in turn drives demand for oil-filled high-voltage transformers that meet these standards. As of 2025, many regions are expected to adopt new efficiency standards, further propelling the market. This regulatory support not only encourages the adoption of advanced transformer technologies but also aligns with broader sustainability goals, thereby fostering growth in the Oil-Filled High-voltage Power Transformer Market.

Infrastructure Development and Urbanization

Rapid urbanization and infrastructure development are pivotal factors influencing the Oil-Filled High-voltage Power Transformer Market. As urban areas expand, the demand for electricity surges, necessitating the installation of high-voltage transformers to support the growing energy requirements. In many regions, significant investments are being made in power infrastructure to accommodate this growth. For instance, the construction of new power plants and substations is expected to bolster the market, with projections indicating a compound annual growth rate of over 5% in transformer installations by 2027. This trend underscores the critical role of oil-filled high-voltage transformers in ensuring a stable and efficient power supply in urbanized areas.

Rising Investments in Smart Grid Technologies

The increasing focus on smart grid technologies is a key driver for the Oil-Filled High-voltage Power Transformer Market. Smart grids enhance the efficiency and reliability of electricity distribution, necessitating the deployment of advanced transformers capable of integrating with digital systems. Investments in smart grid infrastructure are projected to rise significantly, with many countries prioritizing modernization efforts to improve energy management. This trend is likely to create substantial opportunities for the oil-filled high-voltage transformer market, as these transformers play a crucial role in facilitating the transition to smarter, more resilient energy systems. The anticipated growth in smart grid investments could lead to a marked increase in demand for oil-filled high-voltage transformers.

Technological Innovations in Transformer Design

Technological advancements in transformer design are reshaping the Oil-Filled High-voltage Power Transformer Market. Innovations such as improved insulation materials and enhanced cooling systems are leading to more efficient and reliable transformers. These advancements not only increase the operational lifespan of transformers but also reduce maintenance costs, making them more appealing to utility companies. The market is witnessing a shift towards smart transformers that incorporate digital monitoring and control systems, which enhance performance and reliability. As these technologies become more prevalent, they are likely to drive growth in the Oil-Filled High-voltage Power Transformer Market, with an expected increase in adoption rates among energy providers.