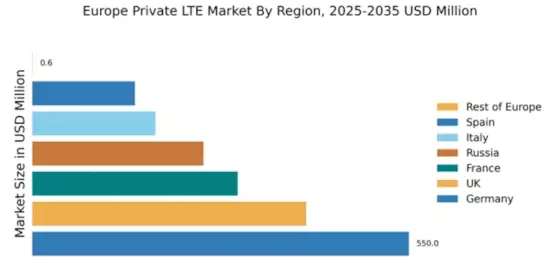

Germany : Strong Infrastructure and Innovation

Germany holds a commanding market share of 550.0, representing approximately 36.7% of the European private LTE market. Key growth drivers include robust industrial automation, increasing demand for IoT applications, and government initiatives promoting digital transformation. The regulatory environment is supportive, with policies aimed at enhancing connectivity and infrastructure development, particularly in urban areas. The country is also investing heavily in 5G technology, which is expected to further boost private LTE adoption.

UK : Innovation and Regulatory Support

The UK private LTE market is valued at 400.0, accounting for about 26.7% of the European market. Growth is driven by advancements in smart city initiatives and the increasing need for secure communication in critical sectors like healthcare and transportation. The UK government has implemented favorable regulations to encourage private LTE deployment, particularly in urban centers. Demand is also rising for private networks in manufacturing and logistics, enhancing operational efficiency.

France : Focus on Smart Technologies

France's private LTE market is valued at 300.0, representing 20% of the European market. The growth is fueled by the government's push for digital innovation and smart city projects. Demand for private LTE is increasing in sectors such as energy and transportation, where secure and reliable communication is essential. Regulatory frameworks are evolving to support the deployment of private networks, particularly in metropolitan areas like Paris and Lyon, enhancing connectivity and industrial growth.

Russia : Diverse Market Potential

Russia's private LTE market is valued at 250.0, making up 16.7% of the European market. Key growth drivers include the need for secure communications in various industries, including oil and gas, and government initiatives aimed at enhancing digital infrastructure. The competitive landscape features major players like Huawei and Ericsson, who are actively involved in deploying private networks. Cities like Moscow and St. Petersburg are pivotal markets, with increasing demand for private LTE solutions in urban development projects.

Italy : Focus on Manufacturing and Logistics

Italy's private LTE market is valued at 180.0, representing 12% of the European market. Growth is driven by the need for enhanced connectivity in manufacturing and logistics sectors, where private LTE can improve operational efficiency. The Italian government is promoting digital transformation through various initiatives, including funding for infrastructure projects. Key markets include Milan and Turin, where major players like Nokia and Cisco are establishing a strong presence to meet local demand.

Spain : Smart Cities and IoT Growth

Spain's private LTE market is valued at 150.0, accounting for 10% of the European market. The growth is driven by the increasing adoption of smart city technologies and IoT applications across various sectors. The Spanish government is actively supporting digital initiatives, creating a favorable regulatory environment for private LTE deployment. Key cities like Barcelona and Madrid are leading the charge, with significant investments from players like Ericsson and ZTE to enhance connectivity.

Rest of Europe : Diverse Opportunities Across Regions

The Rest of Europe has a modest private LTE market value of 0.56, indicating niche opportunities in various smaller markets. Growth is driven by localized demand for secure communication solutions in sectors like agriculture and logistics. Regulatory frameworks are gradually evolving to support private LTE initiatives, although the market remains fragmented. Countries like Belgium and the Netherlands are beginning to see interest from major players, creating potential for future growth in private LTE applications.