Increasing Energy Storage Needs

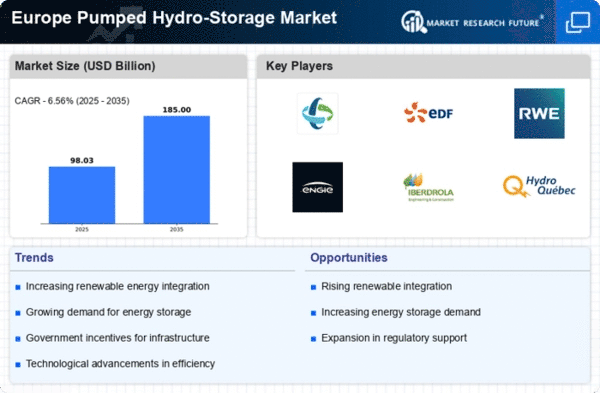

The growing demand for energy storage solutions in Europe is a primary driver for the pumped hydro-storage market. As renewable energy sources, such as wind and solar, become more prevalent, the need for reliable energy storage systems intensifies. Pumped hydro-storage systems can store excess energy generated during peak production times and release it during periods of high demand. This capability is crucial for balancing supply and demand, particularly as Europe aims to achieve its ambitious climate goals. The European Commission has set a target to reduce greenhouse gas emissions by at least 55% by 2030, which further emphasizes the need for efficient energy storage solutions. The pumped hydro-storage market is expected to play a vital role in meeting these storage requirements, potentially leading to an increase in installed capacity across the region.

Support for Decarbonization Initiatives

The European Union's commitment to decarbonization is a crucial driver for the pumped hydro-storage market. With the aim of achieving carbon neutrality by 2050, the EU is implementing various policies and initiatives to reduce reliance on fossil fuels. Pumped hydro-storage systems are recognized for their ability to provide flexible and efficient energy storage, which is essential for integrating renewable energy sources into the grid. The pumped hydro-storage market is likely to see increased demand as countries within Europe strive to meet their decarbonization targets. Furthermore, the EU's Green Deal emphasizes the importance of sustainable energy solutions, which could lead to enhanced funding and support for pumped hydro-storage projects. This alignment with decarbonization goals positions the pumped hydro-storage market as a key player in the transition to a low-carbon economy.

Investment in Infrastructure Development

Investment in energy infrastructure is a significant driver for the pumped hydro-storage market in Europe. Governments and private entities are increasingly allocating funds to enhance energy storage capabilities, recognizing the importance of a resilient energy grid. For instance, the European Investment Bank has committed to financing projects that support renewable energy integration and energy storage solutions. This financial backing is likely to stimulate the development of new pumped hydro-storage facilities, which can provide large-scale energy storage. The pumped hydro-storage market stands to benefit from these investments, as they can lead to the construction of new plants and the modernization of existing facilities. As of 2025, the total investment in energy storage infrastructure in Europe is projected to reach approximately €10 billion, indicating a robust growth trajectory for the pumped hydro-storage sector.

Technological Innovations in Energy Storage

Technological advancements in energy storage solutions are driving the growth of the pumped hydro-storage market in Europe. Innovations in turbine design, control systems, and materials are enhancing the efficiency and reliability of pumped hydro-storage systems. These improvements not only reduce operational costs but also increase the overall capacity of energy storage facilities. The pumped hydro-storage market is likely to benefit from these technological developments, as they enable operators to optimize performance and extend the lifespan of existing plants. As of 2025, it is estimated that advancements in technology could lead to a 20% increase in the efficiency of new pumped hydro-storage installations, making them more competitive against other energy storage technologies.

Rising Electricity Prices and Market Volatility

The volatility of electricity prices in Europe is a significant driver for the pumped hydro-storage market. As energy markets become increasingly unpredictable, the ability to store energy during low-price periods and release it during high-price periods becomes more valuable. Pumped hydro-storage systems can effectively capitalize on these price fluctuations, providing a financial incentive for operators. The pumped hydro-storage market is likely to see growth as more energy producers and consumers recognize the economic benefits of energy storage. In 2025, it is projected that the average electricity price in Europe could rise by 15%, further incentivizing investments in pumped hydro-storage solutions. This economic rationale positions pumped hydro-storage as a strategic asset in managing market risks and enhancing energy security.