Rising Cyber Threats

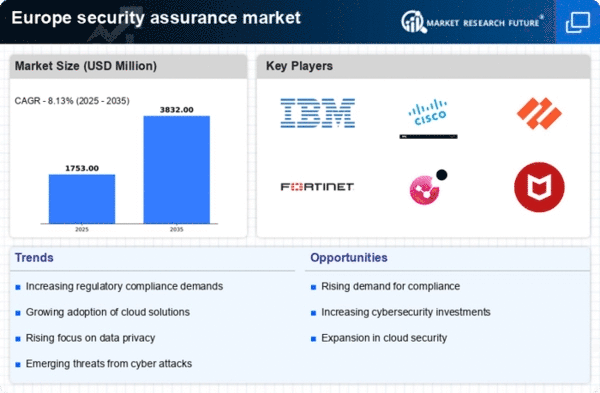

The security assurance market in Europe is experiencing a notable surge due to the increasing frequency and sophistication of cyber threats. Organizations are compelled to enhance their security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost European businesses over €200 billion annually, prompting a heightened focus on security assurance solutions. This trend indicates that companies are investing significantly in security frameworks, risk assessments, and compliance measures to mitigate potential breaches. The growing awareness of the financial and reputational risks associated with cyber incidents is likely to drive demand for robust security assurance services across various sectors, including finance, healthcare, and critical infrastructure.

Evolving Data Protection Regulations

The evolving landscape of data protection regulations in Europe is a critical driver for the security assurance market. With the implementation of the General Data Protection Regulation (GDPR) and other regional laws, organizations are mandated to adopt stringent security measures to safeguard personal data. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. This regulatory environment compels businesses to invest in security assurance solutions to ensure compliance and avoid penalties. As regulations continue to evolve, the demand for security assurance services is expected to grow, as organizations seek to align their practices with legal requirements and enhance their overall security posture.

Increased Awareness of Security Risks

There is a growing awareness among European businesses regarding the potential risks associated with inadequate security measures. This heightened consciousness is driving organizations to prioritize security assurance as a fundamental aspect of their operational strategy. In 2025, surveys indicate that approximately 75% of companies in Europe recognize the importance of investing in security assurance solutions to protect against data breaches and cyber threats. This trend suggests that businesses are increasingly viewing security assurance not merely as a compliance requirement but as a strategic necessity. Consequently, the security assurance market is likely to expand as organizations seek to implement comprehensive security frameworks that address both current and emerging threats.

Shift Towards Cloud-Based Security Solutions

The shift towards cloud-based security solutions is reshaping the security assurance market in Europe. As organizations increasingly migrate their operations to the cloud, the need for robust security measures to protect cloud environments becomes paramount. In 2025, it is anticipated that the cloud security market will reach €10 billion, reflecting the growing reliance on cloud services. This trend indicates that businesses are seeking security assurance solutions that are specifically designed for cloud environments, including identity and access management, data encryption, and threat detection. The transition to cloud-based security solutions is likely to drive innovation and competition within the security assurance market, as providers develop tailored offerings to meet the unique challenges posed by cloud computing.

Technological Advancements in Security Solutions

Technological advancements are significantly influencing the security assurance market in Europe. Innovations such as artificial intelligence (AI), machine learning, and blockchain are being integrated into security solutions, enhancing their effectiveness in threat detection and response. In 2025, the market for AI-driven security solutions is projected to grow by over 30%, reflecting the increasing reliance on advanced technologies to bolster security assurance. These advancements enable organizations to proactively identify vulnerabilities and respond to incidents in real-time, thereby reducing the potential impact of security breaches. As businesses continue to adopt these cutting-edge technologies, the demand for security assurance services is expected to rise, driving market growth.